A new EDB study reveals that moving up the technology ladder will unlock the enormous industrial potential of the Eurasian region.

Almaty, 7 October 2025

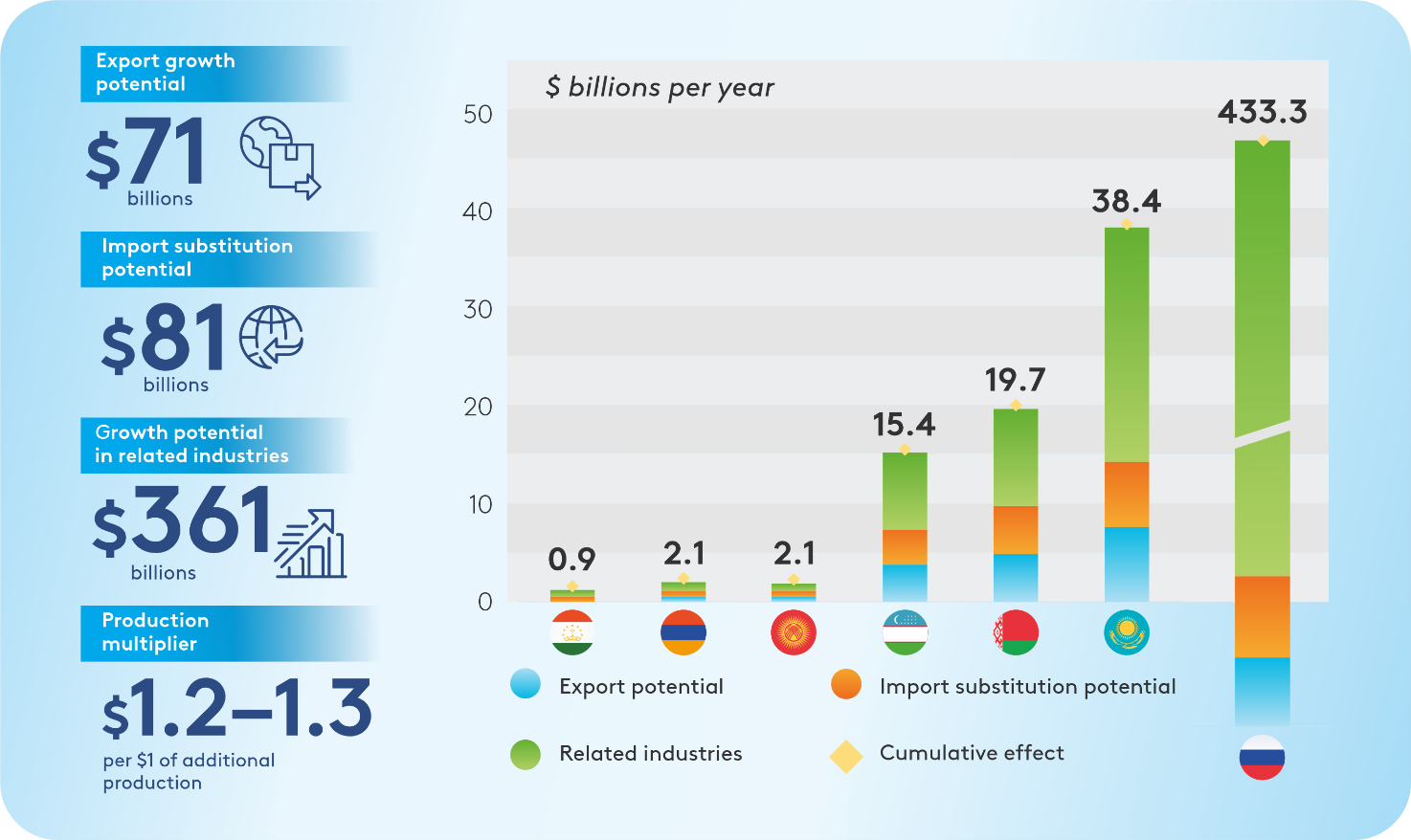

The Eurasian Development Bank (EDB) has presented the results of a new research entitled "Advanced Manufacturing Potential in Eurasia: Sectoral Niches for Growth." According to the report, transitioning from a raw materials export model to developing high value-added industries could generate $510 billion for the region's economy each year. The study identifies priority industries and products for each country, assesses the potential for export growth and import substitution, and proposes measures to promote industrial development and integration into global value chains. The report's conclusions are relevant for the formation of industrial policy in the region's countries and for identifying business opportunities for investment.

Key findings of the study:

- Export growth: the industrial potential of the Eurasian region allows for an increase in annual exports of over $70 billion.

- Import substitution: import localisation is possible with an economic effect of over $80 billion per year.

- Cumulative effect: realising export and import substitution potential (taking into account related industries) could generate more than $510 billion in additional output annually.

- Priority industries: chemical industry (including pharmaceuticals), machine building, metallurgy and food industry – sectors with the greatest growth potential and multiplier effect.

For decades, the economies of the Eurasian region (Armenia, Belarus, Kazakhstan, Kyrgyzstan, Russia, Tajikistan and Uzbekistan) have developed mainly through the extraction and export of raw materials. While this model ensured an inflow of foreign currency, it also made the countries vulnerable, as a significant proportion of high-value products were imported and industry remained technologically heterogeneous, focusing on minimal resource processing.

International experience shows that the limitations of the raw materials model can be overcome through industrial diversification and moving up the technological value chain. At higher stages of development, knowledge-intensive and high-tech goods play a greater role, and their production contributes to sustainable long-term growth. Developing deep processing industries creates new sectors of the economy, reduces environmental impact, and increases technological sustainability. In the context of global transformations, it is high-tech industry that determines countries' sustainability and innovative competitiveness.

In order to realise industrial potential, the report proposes an active industrial policy aimed at diversifying the economy and developing high-value manufacturing. A key principle is combining efforts to replace imports with building export potential. This balanced approach will enable to reduce vulnerability to external shocks while occupying niches in high-yield segments of the global market.

The report recommends focusing development efforts on priority sectors with maximum economic and integration effects: chemicals (including pharmaceuticals), machine building, metallurgy and food. These sectors have the greatest growth potential and can generate a significant multiplier effect for the economy. At the same time, each country should develop niche segments of "second processing" (deep processing) to create its own growth opportunities, making use of local strengths. Another task is to localise the production of critical components and materials. Reducing dependence on imported components will strengthen economic security and lay the groundwork for further expansion into foreign markets.

Technologically, the long-term priorities of industrialisation are linked to the digitalisation and automation of production based on Industry 4.0 concepts, such as the introduction of artificial intelligence, robotisation, the Internet of Things, and digital twins. At the same time, the development of biotechnology, pharmaceuticals, and the new materials industry (e.g. nanomaterials and composites) should be stimulated, and the principles of environmental sustainability and the circular economy should be universally implemented. These measures will increase the technological complexity of manufactured products and ensure the Eurasian region's integration into global innovation processes, which is crucial for achieving sustainable development goals.

Effective implementation of the proposed measures will require a partnership between the state, businesses and the scientific community to coordinate priorities and accelerate technology transfer. The industrial policy management system must be improved by introducing transparent indicators and KPIs, regularly monitoring results, and adjusting support measures as necessary. At the same time, investment in human capital is necessary: educational programmes must be modernised, engineering and management skills developed, and academic mobility of personnel encouraged. The set of tasks is completed by improving the institutional environment and investment climate to facilitate the implementation of new projects.

All of these initiatives are interrelated and require comprehensive implementation. Their implementation will enable the region's existing industrial potential to be realised. The region's industrial potential today allows to expect a significant increase in manufacturing exports estimated at $70 billion annually. The largest relative growth is possible in smaller economies, such as Kyrgyzstan, Uzbekistan and Armenia, where exports could increase by a quarter or more. Meanwhile, an increase of 12–17% is expected in Russia, Belarus, Kazakhstan and Tajikistan. Import substitution is seen as a comparable growth reserve. According to EDB estimates, replacing foreign goods with domestic production generates over $80 billion annually. Overall, countries in the region have the capacity to replace 11–23% of imports by localising equipment and component production. Such measures reduce external vulnerability, strengthen the industrial base and stimulate the technological modernisation of the economy.

Summary assessment of the implementation of industrial potential development in the Eurasian region

Source: EDB calculations.

The EDB estimates that the cumulative economic effect of realising export potential and import substitution programmes, taking into account the growth of related industries, is more than $510 billion per year. This growth covers supplies to external markets and domestic demand, stimulating the development of related industries, such as energy, transport, trade, agriculture, chemicals and metallurgy. Essentially, a new industrial ecosystem is forming in Eurasia, capable of generating enormous added value within the region.

The EDB's recommendations, which are based on an analysis of the region's strengths and weaknesses, are designed to help Eurasian countries transition to a more complex industrial structure. The key objective is to establish a modern industrial system that can process raw materials within the region, create jobs, and produce technologically complex products. Eurasia's natural resource advantages provide a unique opportunity to pursue a new type of industrialisation that is focused on added value, sustainable development, and technological leadership.

For more details on the report "Advanced Manufacturing Potential in Eurasia: Sectoral Niches for Growth," please visit the Bank's website.