China’s investment stock in Eurasia exceeds US $66 billion: a new report by the EDB

The Eurasian Development Bank (EDB) has released its second report under the flagship Monitoring of Mutual Investments project. The paper focuses on China, the Eurasian region’s leading investment partner in 2025, and shows that Chinese investment in the region continues to grow steadily despite the global decline in FDI flows. Over the past ten years, this investment has increased by 80% to a record US $66 billion by the end of the first six months of 2025. In the past, China invested mainly in extractive industry projects, but now manufacturing and energy projects are becoming new drivers of growth.

Key findings:

- China’s investment in Eurasia is growing amid a global downturn. Over the past 18 months, Chinese investment in the Eurasian region increased by US $7.4 billion (+13% compared with 2023), while global FDI flows fell by 11% in 2024.

- Cooperation has been confirmed at the high level. The priority of investment cooperation is enshrined in the Tianjin Declaration of the SCO and the Astana Declaration of the Second Central Asia–China Summit and is aligned with the objectives of the Belt and Road Initiative.

- Private Chinese business is expanding its presence in the region. Its share in the investment structure rose from 22% to 27% over ten years, while the share of state-owned companies declined from 62% to 53%.

- A structural shift from extractive industries to manufacturing and energy. The share of manufacturing increased from 13% to 22% and that of the energy sector from 4% to 12%, while the share of extractive industries fell from 68% to 54%.

- In Central Asia, Kazakhstan leads in terms of the volume of attracted investments, while Uzbekistan leads in growth rates. Over 10 years, Chinese FDI in Uzbekistan grew by US $10.4 billion. China's total investment stock in Central Asia reached $36 billion by mid-2025.

- Greenfield projects dominate. The share of greenfield investment rose from 43% to 60%, reflecting the technological maturity of Chinese companies.

More about the report:

The Eurasian Development Bank (“EDB,” the “Bank”) continues its series of publications under the flagship analytical project Monitoring of Mutual Investments, based on a unique database of investment projects containing detailed information on mutual FDI stock. The database is built bottom-up, drawing on verified information from open sources such as corporate reports, state registers, statistical agencies and business media.

The priority of developing investment cooperation between China and Eurasian countries has been confirmed at high bilateral and multilateral levels, including in the Tianjin Declaration of the Council of Heads of State of the Shanghai Cooperation Organisation (Tianjin, China, 1 September 2025) and at the Second Summit of the Heads of State of Central Asia and China (Astana, Kazakhstan, 17 June 2025). The expansion of mutual investment is consistent with the priorities of the Belt and Road Initiative implemented by China and Eurasian countries.

According to the EDB’s mutual investment database, mutual foreign direct investment (FDI) stock between China and Eurasian countries has been growing steadily in recent years, against a continued decline in global investment activity. In 2024, global FDI inflows (excluding intermediary operations) decreased by 11%, with the decline continuing for the second year in a row.

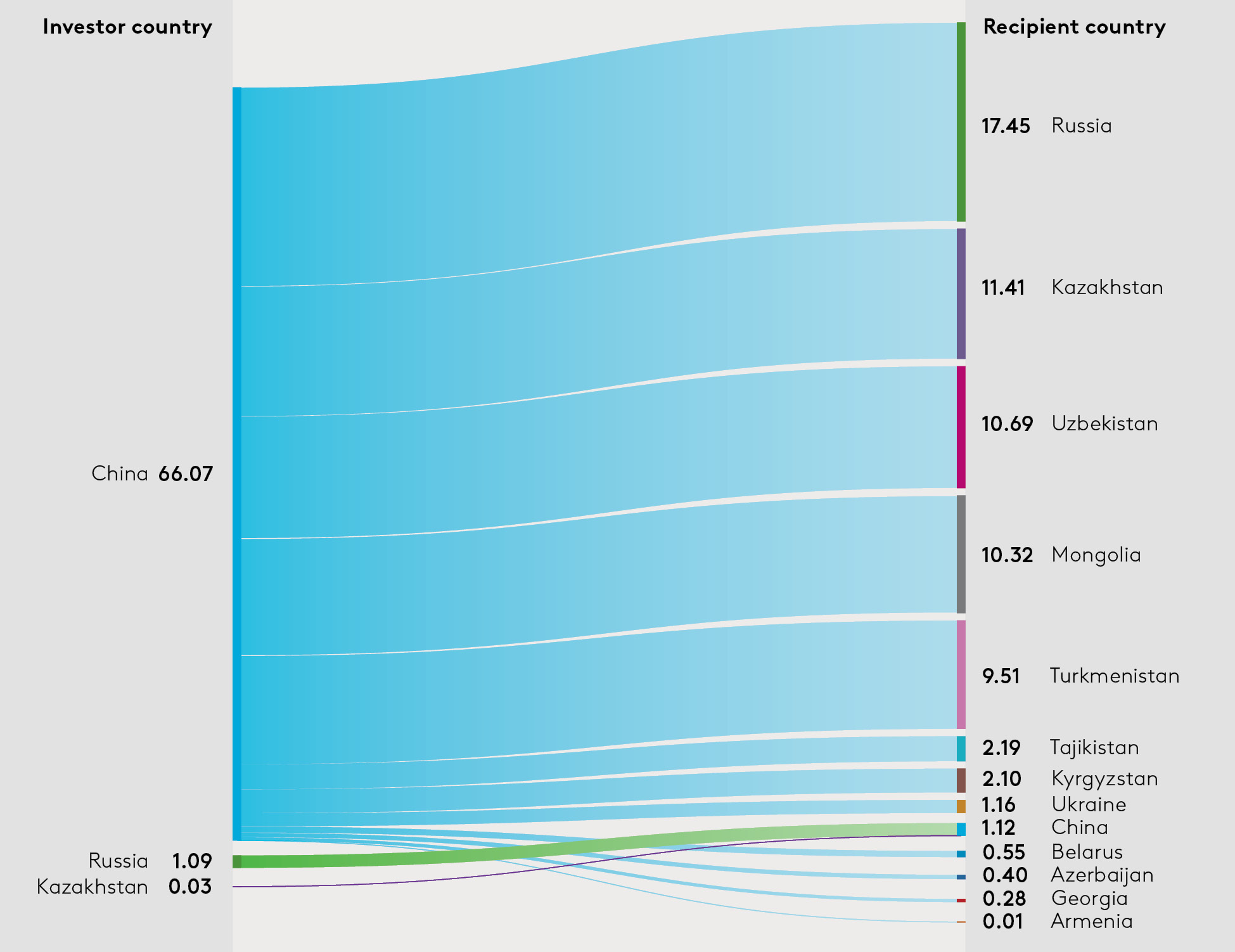

The total mutual FDI stock reached US $67.2 billion, including US $66.1 billion invested by China in the Eurasian region and US $1.12 billion invested by Eurasian countries in projects implemented in China.

The report identifies four key trends in investment cooperation:

1. A shift in the sectoral structure towards manufacturing and energy, while the share of extractive industries declines.

2. Uzbekistan’s emergence as the main destination for Chinese investment and the key growth driver in Central Asia, with its share of the regional portfolio increasing from 1% to 16%.

3. A strengthening role of private business in the investment process.

4. An increase in the share of greenfield projects underpinning the development of new industrial and energy infrastructure in the region.

Mutual investment flows between China and Eurasian countries, US $ billions

Source: EDB MMI database.

“China has established itself as a key investment partner for Eurasian countries. In recent years, Chinese companies have shifted their focus towards creating new manufacturing and energy production facilities. Most of the new projects are private business investments. This demonstrates the technological maturity of Chinese investors. But it also shows a significant improvement in the investment climate in Central Asia,” commented Evgeny Vinokurov, Chief Economist at the EDB.

China’s FDI stock in Central Asia has increased over ten years to US $35.9 billion. Almost 90% of investment is concentrated in Kazakhstan (32%), Uzbekistan (30%) and Turkmenistan (27%). To date, investment has been largely concentrated in extractive industries (46%), although the share of manufacturing and energy, which together already account for more than one third of Chinese investment in Central Asia, continues to grow. Kazakhstan remains the largest recipient of Chinese FDI at US $11.4 billion, while Uzbekistan is showing rapid growth and has increased attracted FDI to US $10.7 billion by mid-2025.

Over the past ten years, China’s FDI stock in the South Caucasus increased 2.5 times, from US $0.28 billion to US $0.69 billion. The investment portfolio is divided between Azerbaijan (around 60%) and Georgia (around 40%), with manufacturing and energy as the priority sectors.

China’s total FDI stock in EAEU countries is estimated at US $31.5 billion across 160 projects. Over the past ten years, Chinese investment in the EAEU has grown by 1.5 times. Russia and Kazakhstan account for 91% of total investment. While extractive industries remain the key recipient with US $14.7 billion (47% of the portfolio), manufacturing investment is expanding rapidly (US $9.8 billion, or 31%, by mid-2025).

Russia is the largest recipient of Chinese FDI. As of the first half of 2025, the investment stock there reached US $17.5 billion, accounting for 55% of China’s total investment in the EAEU. The largest project is Sinopec’s participation in the Amur Gas Chemical Complex, in which the company holds a 40% stake. By mid-2025, cumulative investment in the project reached US $3.2 billion.

China’s investment stock in Mongolia has reached a very high level, amounting to US $10.3 billion by mid-2025. The portfolio is concentrated in the mining sector, primarily in projects developing iron ore and oil deposits.

Manufacturing, energy including renewables, transport and logistics and agriculture remain the most attractive sectors for Chinese investors in the Eurasian region. This reflects a combination of structural shifts within Eurasian economies and China’s strategic priorities to secure leadership in high-tech industries, diversify value chains, develop green energy and low-carbon transport and ensure food security.

The report and research materials are available on the Bank’s website.

Additional Information:

The Eurasian Development Bank (EDB) is a multilateral development bank investing in Eurasia. For more than 19 years, the Bank has worked to strengthen and expand economic ties and foster comprehensive development in its member countries. By July 2025, the EDB’s cumulative portfolio comprised 319 projects with a total investment of US $19.1 billion. The portfolio consists principally of projects with an integration effect in transport infrastructure, digital systems, green energy, agriculture, manufacturing and mechanical engineering. The Bank adheres to the UN Sustainable Development Goals and ESG principles in its operations.

The EDB is implementing three mega-projects as part of its 2022–2026 Strategy: the Central Asian Water and Energy Complex, the Eurasian Transport Network and the Eurasian Agricultural Goods Distribution System.

The EDB Media Centre:

+7 (727) 244 40 44, ext. 4774 and 2160