Investment inflows into the Eurasian region from Asian countries in 2024–2025 amounted to US $20 billion, of which US $9 billion was invested by the Gulf states

The inflow of Asian capital into Eurasian countries in 2024–2025 amounted to US $20 billion, despite a global decline in investment, according to a new report by the Eurasian Development Bank (EDB) based on the Monitoring of Mutual Investments (MMI) project. Almost half of this increase (US $9 billion) was provided by the Gulf states. The total stock of mutual investments between the countries of the Eurasian region and Asia (China, the Gulf states, Türkiye, India, Vietnam and others) reached a record high of US $176 billion.

Key findings:

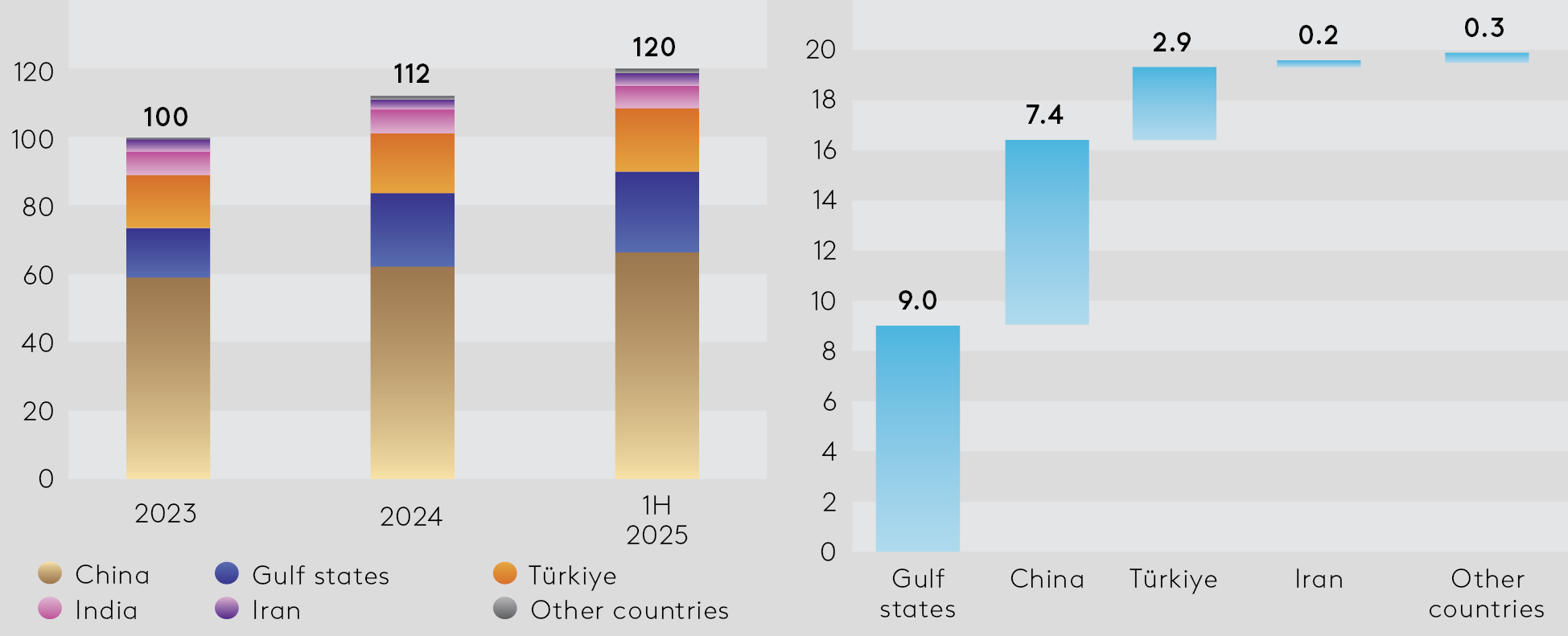

- Record investment volumes: By mid-2025, investment stock in the Eurasian region from Asian countries reached a record US $120 billion, continuing its steady growth.

- Primary growth driver: In 2024-2025, the Gulf states accounted for almost half of the increase in investment stock in the Eurasian region from Asian countries, amounting to US $9 billion.

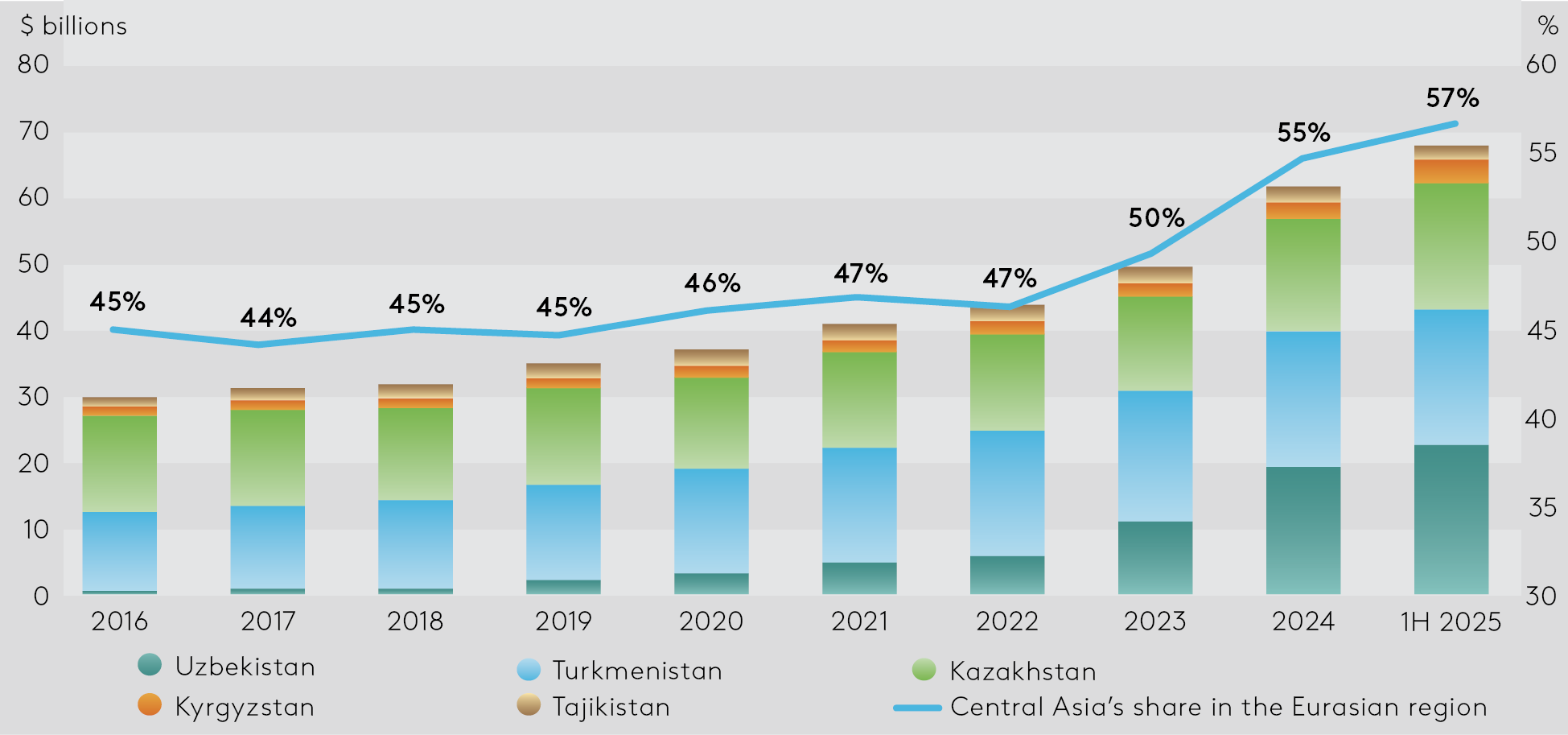

- Key FDI destination: Central Asia accounts for almost 57% of all Asian investment, totalling US $68 billion. The main recipients are Kazakhstan, Uzbekistan and Turkmenistan.

- Most attractive sector: The power sector accounted for more than half of new capital inflows in 2024–2025 (US $10.1 billion out of US $19.8 billion).

- Investments by Eurasian countries in Asia: Growth continues. By mid-2025, investment stock reached US $56.6 billion, with Türkiye and India as the key destinations.

More about the report:

The Eurasian Development Bank (“EDB”, “the Bank”) continues its series of publications under its flagship analytical project Monitoring of Mutual Investments, based on a unique database of investment projects containing detailed information on mutual FDI stock. The database is built bottom-up, drawing on verified information from open sources such as corporate reports, state registers, statistical agencies and business media.

The total stock of mutual investments between 13 countries of the Eurasian region (Armenia, Azerbaijan, Belarus, Georgia, Kazakhstan, the Kyrgyz Republic, Moldova, Mongolia, Russia, Tajikistan, Turkmenistan, Ukraine and Uzbekistan) and partner countries in Asia (Afghanistan, Vietnam, India, Indonesia, Iran, China, Türkiye and the Gulf states – Bahrain, Qatar, Kuwait, the UAE, Oman and Saudi Arabia) reached a record US $176 billion. It has been growing steadily since 2016 and has doubled over the past ten years.

By mid-2025, total FDI stock attracted to the Eurasian region from Asian countries reached US $119.8 billion, representing a 20% increase compared to 2023.

Investment stock from Asian countries in the Eurasian region (left) and investment growth by investor country from 2023 to the first half of 2025 (right), US $ billions

Source: EDB MMI database

The main investors are companies from China (US $66.1 billion, or 55% of the total), the Gulf states (US $23.9 billion, or 20%), Türkiye (US $12.3 billion, or 15.5%), and India (US $6.8 billion, or 5.7%). Collectively, these countries account for approximately 96% of total investment stock attracted from Asia.

China remains the largest investor in the Eurasian region, while the Gulf states have played a pivotal role in driving investment growth in recent years. They made the largest contribution to investment growth over the past year and a half. Of the total increase in investment from Asian countries of US $20 billion, the Gulf states accounted for about US $9 billion, or 45%. Over the long term, they have demonstrated the highest investment growth rates in the Eurasian region, averaging 13.9% per year since 2016.

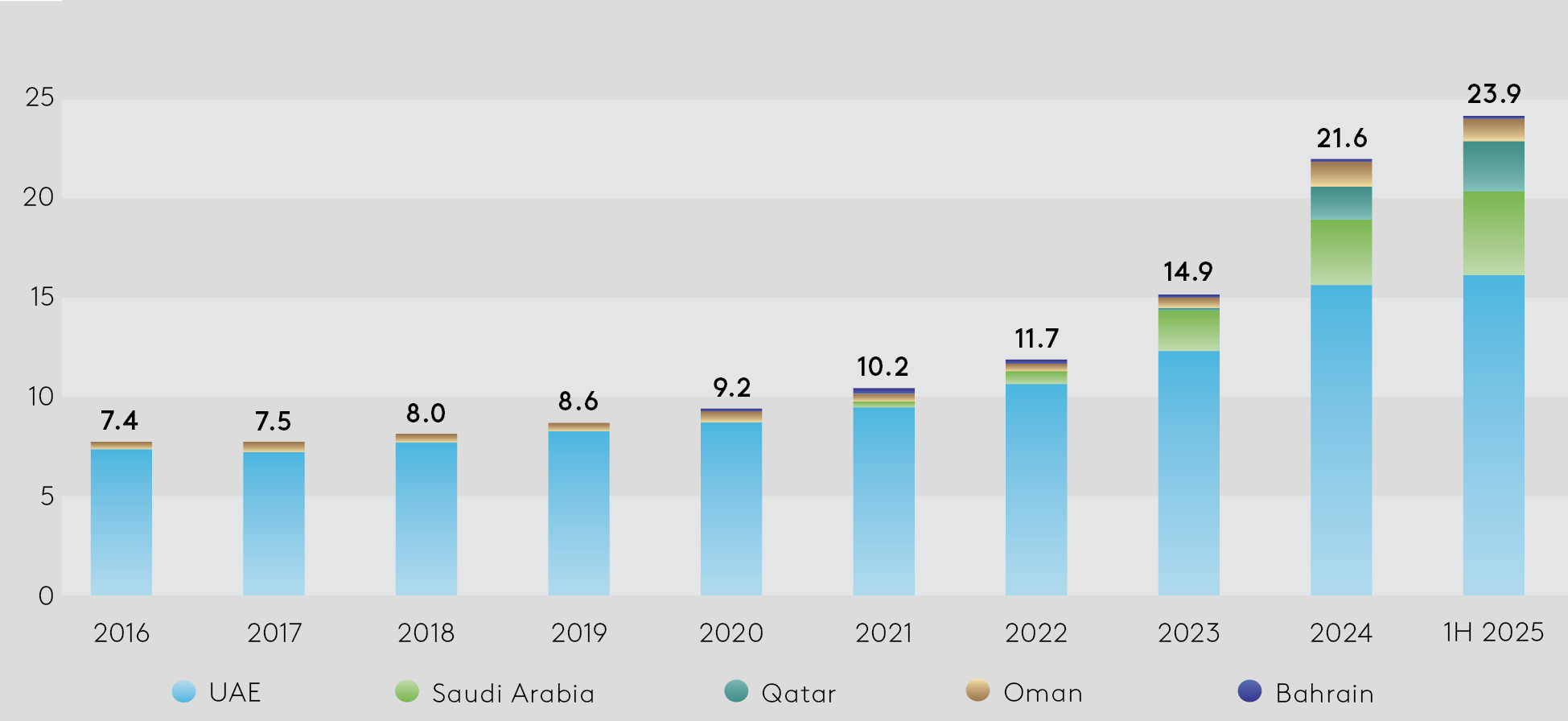

Among the Gulf states, companies from the UAE are the leading investors, with a portfolio of US $16.1 billion (68%). Investments from Saudi Arabia (US $4.2 billion as of the end of the first half of 2025), Qatar (US $2.4 billion) and Oman (US $1.1 billion) are growing rapidly. Almost 96% of all Gulf investment in the Eurasian region is concentrated in Central Asian countries. In addition, the Gulf states are investing in Azerbaijan (US $0.6 billion), Armenia (US $0.17 billion), Georgia (US $0.16 billion), the Kyrgyz Republic (US $0.1 billion) and other economies.

Dynamics of FDI stock from the Gulf states to the Eurasian region, US $ billions

Source: EDB MMI database

“We are observing steady growth in investment ties between the Gulf states and the Eurasian region. We expect this strong investment momentum to continue in the medium term, averaging 15% per year. Several factors will contribute to this positive outlook, including a substantial portfolio of projects preparing for launch and the strengthening of political and economic ties between our countries. The Gulf states are making 'mature' investments. Investor companies are bringing advanced technologies to the region and contributing to the development of high-level industrial expertise," commented Evgeny Vinokurov, Chief Economist at the EDB.

Central Asia is a particularly attractive destination for Asian investors. Cumulative investment from Asian countries into Central Asian economies between 2016 and the first half of 2025 increased 2.3 times, from US $29.9 billion to US $68 billion. By the end of the first half of 2025, Central Asia accounted for up to 57% of the total accumulated direct investment attracted from Asian countries. The bulk of this investment (92%) is concentrated in three countries: Uzbekistan (US $22.6 billion), Turkmenistan (US $20.6 billion) and Kazakhstan (US $19.3 billion).

Uzbekistan has recorded the fastest pace of investment inflows, increasing its FDI stock from Asian countries more than 45-fold compared to 2016. In the 2024–2025 financial year alone, investment doubled from US $11.0 billion to US $22.6 billion. Uzbekistan accounted for approximately 62% of total investment growth in Central Asia, reflecting improvements in the investment climate, industrial modernisation and energy transformation.

Investment stock from Asian countries in Central Asia

Source: EDB MMI database

Countries in the Eurasian region are also actively investing in Asian countries. By mid-2025, their investments in Asia had reached US $56.6 billion, an increase of 12.5% over the previous year and a half.

The main investors from the Eurasian region are Russia and Azerbaijan, accounting for 72% and 23% of FDI, respectively. The main recipient countries are Türkiye (78% of investment outflows from the Eurasian region), India (12%), Vietnam (4%) and China (2%).

Türkiye is the largest recipient of investment, with investment stock from Eurasian countries reaching US $44 billion. The main contributors are Russian and Azerbaijani companies, particularly in the energy and oil refining sectors. Kazakhstan has also become one of the major investors in Türkiye.

Investment from Eurasian countries in India increased more than sevenfold, reaching US $6.6 billion. The main investors are Russia, Kazakhstan and Azerbaijan.

Investment in Vietnam reached US $2.35 billion, with Russia and Kazakhstan as the primary investors.

Investment by Central Asian countries (Kazakhstan, Turkmenistan, Uzbekistan) and Azerbaijan in Afghanistan's economy is also increasing. By mid-2025, total FDI stock had reached US $190 million.

A steady structural shift is under way away from the dominance of extractive industries towards a more diversified investment model. By mid-2025, manufacturing accounted for 23% of mutual FDI stock, becoming a key driver of industrial cooperation in the Eurasian region.

Over the past decade, the investment landscape of the Eurasian region has changed significantly, with the share of the power sector rising sharply from 2% to 17%. In the past year and a half alone, power generation projects accounted for more than half of total growth in investment attracted to Eurasian countries (US $10.1 billion out of US $19.8 billion).

The Gulf states and China are the most active investors in the power sector, including renewable energy. Investments from the Gulf states totalled approximately US $5 billion.

The acceleration of FDI inflows into the power sector reflects a combination of factors, including rapid growth in domestic electricity demand and the accelerating energy transition in Eurasia, supported by renewable energy projects.

The full report and related research materials are available on the Bank’s website.

Additional Information:

The Eurasian Development Bank (EDB) is a multilateral development bank investing in Eurasia. For more than 19 years, the Bank has worked to strengthen and expand economic ties and foster comprehensive development in its member countries. By the end of December 2026, the EDB’s cumulative portfolio comprised 326 projects with a total investment of US $19.6 billion. The portfolio consists principally of projects with an integration effect in transport infrastructure, digital systems, green energy, agriculture, manufacturing and mechanical engineering. The Bank adheres to the UN Sustainable Development Goals and ESG principles in its operations

The EDB is implementing three mega-projects as part of its 2022–2026 Strategy: the Central Asian Water and Energy Complex, the Eurasian Transport Network and the Eurasian Agricultural Goods Distribution System.

The EDB Media Centre:

+7 (727) 244 40 44, ext. 4774 and 2160