Mutual investment in the Eurasian region reached a record US $48.4 billion: a new report by the EDB

The Eurasian Development Bank (EDB) has released the report as part of its flagship project Monitoring of Mutual Investments. New data show that investment activity in the Eurasian region continues to expand despite the global decline in foreign direct investment (FDI). Mutual FDI between the region’s countries reached a record US $48.4 billion at the end of the first half of 2025, with private business being the main growth driver.

Summary of key findings:

· Record investment amid global downturn: Mutual FDI stock in the Eurasian region reached US $48.4 billion (+6.4% compared with 2023), while global FDI flows in the world decreased by 11% in 2024.

· Private business as main growth driver: The share of private companies rose to 72%, with their total FDI amounting to US $34.7 billion.

· Shift from extractive industries to manufacturing: The share of extractive industries declined, while investment in manufacturing increased by a record US +$1.5 billion over 18 months.

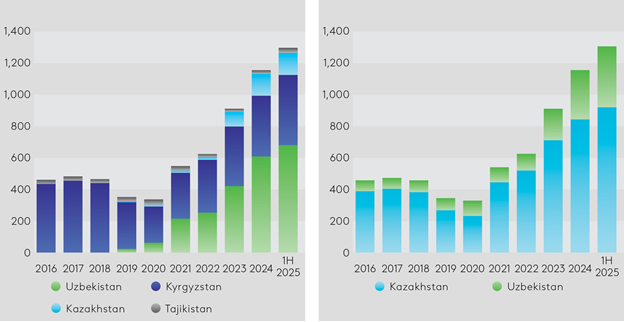

· Investment boom in Central Asia: Intra-regional FDI in Central Asia rose to US $1.3 billion (+42% compared with 2023), with 80% directed to construction, manufacturing and the financial sector, reflects the priority of the development of the industrial and infrastructural base of the region.

· Kazakhstan and Uzbekistan as key regional players: Kazakhstan is among the largest investors and recipients (with cumulative outbound investment standing at US $3.25 billion and inbound at US $9.4 billion), while Uzbekistan is the largest FDI recipient (US $10.7 billion, or 22.3% of the regional total).

More about the report:

The Eurasian Development Bank (“EDB,” the “Bank”) continues its series of publications under the flagship analytical project Monitoring of Mutual Investments, based on a unique database of investment projects containing detailed information on mutual FDI stock. The database is built bottom-up, drawing on verified information from open sources such as corporate reports, state registers, statistical agencies and business media.

According to the EDB’s mutual investment database, mutual FDI stock in the Eurasian region has grown steadily in recent years. This has taken place against a continued decline in global investment. In 2024, global FDI inflows (excluding intermediary operations) decreased by 11%, with the decline continuing for the second year in a row.

Private companies remain the key driver of mutual investment. Their share increased from 63% in 2016 to 72% by mid-2025, and their total FDI reached US $34.7 billion, an increase of almost US $13 billion.

By mid-2025, greenfield projects had become the dominant type of investment in the region for the first time, with their share rising to 40%, while the share of brownfield projects fell to 39%.

Mutual FDI remains concentrated in three sectors: extractive industries (US $14.3 billion), manufacturing (US $8.9 billion) and transport and logistics (US $5.4 billion). Together, these account for around 60% of the total FDI stock. The structure is, however, shifting: over the past 18 months the share of extractive industries has declined by 4 percentage points to 29.6%, while investment in manufacturing and the financial sector increased by a record US $1.5 billion and US $1.4 billion respectively.

Growth in manufacturing was mainly driven by projects in Kazakhstan in the petrochemical and fertiliser industries. The surge in financial-sector investment was driven by Georgian investors acquiring stakes in banking assets in Armenia, Belarus and Uzbekistan.

Investment dynamics vary across countries, both in terms of pace and sectoral structure.

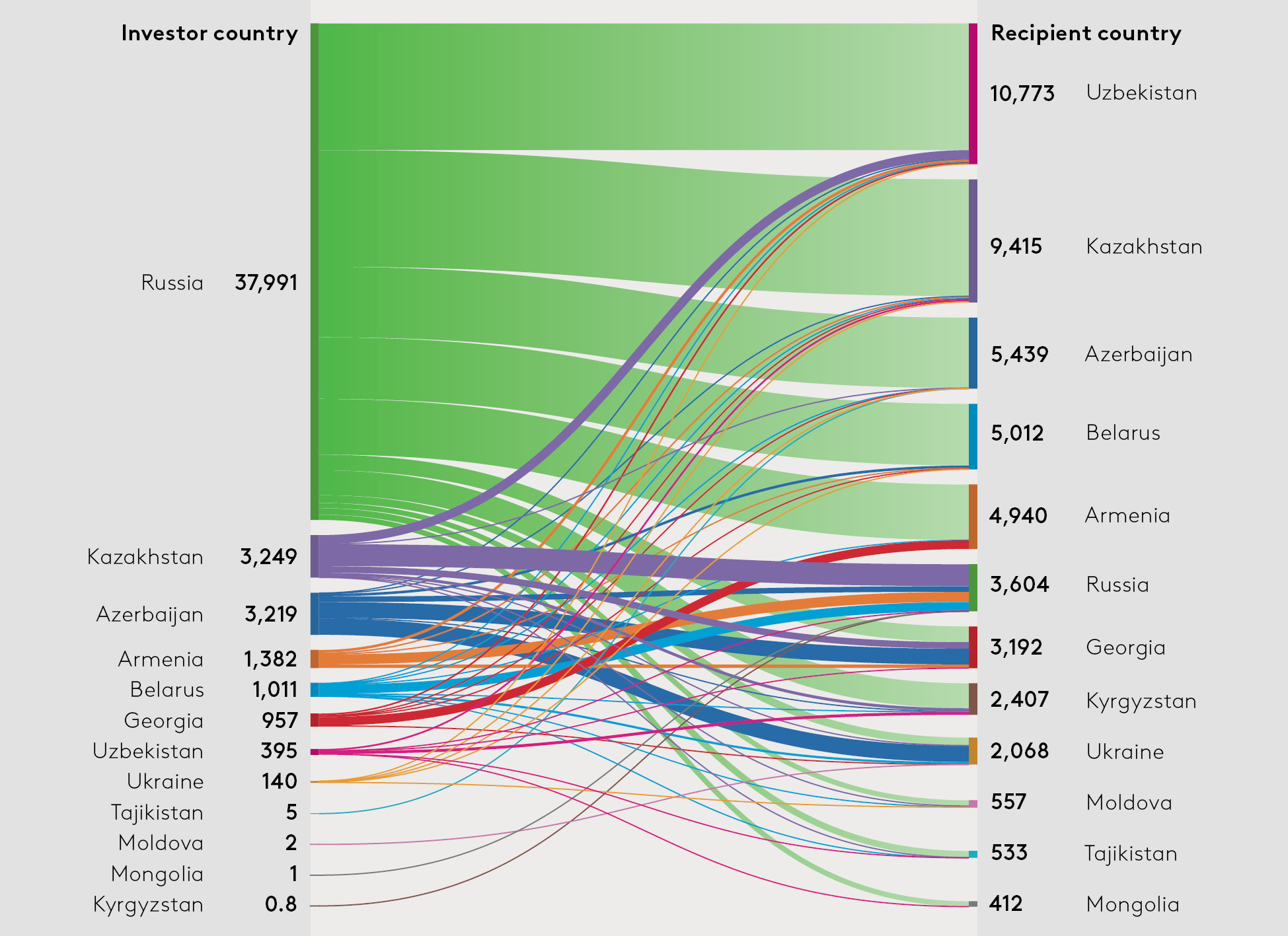

Directions of mutual FDI stock in Eurasian countries, US $ millions

Source: EDB FDI database.

Armenia maintains a balanced position as both an investor and a recipient. Its outbound FDI reached US $1.4 billion (+15% compared with 2023), while inbound FDI rose to US $4.9 billion (+25%). Russian capital accounts for 86% of inflows, although two-thirds of the growth in the past 18 months came from Georgian investors, primarily through investments in the financial sector.

In Azerbaijan, the volume of attracted FDI increased to US $5.4 billion, with an average annual growth rate of 11.7% since 2021. The key factor is the increase in investment into the Shah Deniz project.

Belarus increased outbound investment to US $1 billion (+50% compared with 2023), while inbound FDI reached US $5.4 billion (+8.5%).

Kazakhstan remains one of the key players: outbound investment stock totals US $3.25 billion, and inbound investment amounts to US $9.4 billion (19.5% of all mutual FDI in the region). In recent years, neighbouring Uzbekistan has become an important destination for Kazakhstan’s capital exports. Over the past 18 months, Kazakhstan’s investment there has increased by 60%, mainly in construction.

The Kyrgyz Republic continues to attract growing inflows. Incoming FDI reached US $2.4 billion (+21% compared with 2023), with most of the 18-month increase coming from manufacturing and energy projects.

Russia remains the largest investor in the Eurasian region, accounting for 78.6% of mutual FDI exports (US $38 billion), mainly in the oil and gas sector of the region’s countries. Inbound FDI stock to Russia from Eurasian countries is much lower at US $3.6 billion.

Tajikistan continues to increase mutual FDI from Eurasian countries, reaching US $0.53 billion by mid-2025 (+3% compared with 2023). Russian investment dominates (93%), concentrated in energy, telecommunications and the financial sector.

Uzbekistan is the largest investment recipient in the Eurasian region, with the inbound FDI stock exceeding US $10.7 billion (22.3% of the regional total). The country also doubled its outbound investment compared with 2023, reaching US $396 million. Uzbekistan’s companies invested mainly in manufacturing (85%) in other Eurasian countries. Russia accounts for 90% of total investment into Uzbekistan.

Within the Eurasian Economic Union, mutual investment reached a historic high of US $23.4 billion (+42% compared with 2016). The EAEU’s share in total mutual FDI in the Eurasian region rose to 48.4%.

In the CIS, mutual FDI stock increased to US $41.6 billion (+56% compared with 2016). Investment flows are increasingly shifting towards Central Asia, particularly Uzbekistan and Kazakhstan.

Intra-regional investment in Central Asia reached US $1.3 billion in the first half of 2025, up 42% compared with 2023 and nearly triple the level of 2016. Kazakhstan remains the largest regional capital exporter, while Uzbekistan is the main recipient. Approximately 80% of all intra-regional investment is concentrated in construction, manufacturing and the financial sector, reflecting the region’s gradual shift from the dominance of extractive sectors to a more diversified investment structure.

Importing (left) and exporting (right) countries of intra-regional FDI in Central Asia, US $ millions

Source: EDB MDI database.

“Investment activity in the Eurasian region is rising in 2025. The more than US $48 billion of mutual FDI stock is an absolute record for the entire observation period. Increasing volumes of capital, mainly private, are flowing into manufacturing, helping to shift the region’s specialisation towards higher-value-added industries. Mutual investment in Central Asia is growing especially fast. Over the past five years, the average annual growth rate of mutual investment in the region has been 24.4%, an order of magnitude higher than for the Eurasian region as a whole. Growth has been driven by Kazakhstan’s successful strategy for improving its investment climate and Uzbekistan’s policy of encouraging foreign investment,” said Evgeny Vinokurov, Chief Economist at the EDB.

Four sectors are becoming increasingly attractive to foreign investors: manufacturing, energy including renewables, transport and logistics, and the agro-industrial sector.

The full report and related research materials are available on the Bank’s website.

Additional Information:

The Eurasian Development Bank (EDB) is a multilateral development bank investing in Eurasia. For more than 19 years, the Bank has worked to strengthen and expand economic ties and foster comprehensive development in its member countries. By July 2025, the EDB’s cumulative portfolio comprised 319 projects with a total investment of US $19.1 billion. The portfolio consists principally of projects with an integration effect in transport infrastructure, digital systems, green energy, agriculture, manufacturing and mechanical engineering. The Bank adheres to the UN Sustainable Development Goals and ESG principles in its operations.

The EDB is implementing three mega-projects as part of its 2022–2026 Strategy: the Central Asian Water and Energy Complex, the Eurasian Transport Network and the Eurasian Agricultural Goods Distribution System.

The EDB Media Centre:

+7 (727) 244 40 44, ext. 4774 and 2160