New Study by the EDB: Warehousing Infrastructure in Eurasia – An Opportunity of the Decade

Almaty, 23 October 2025.

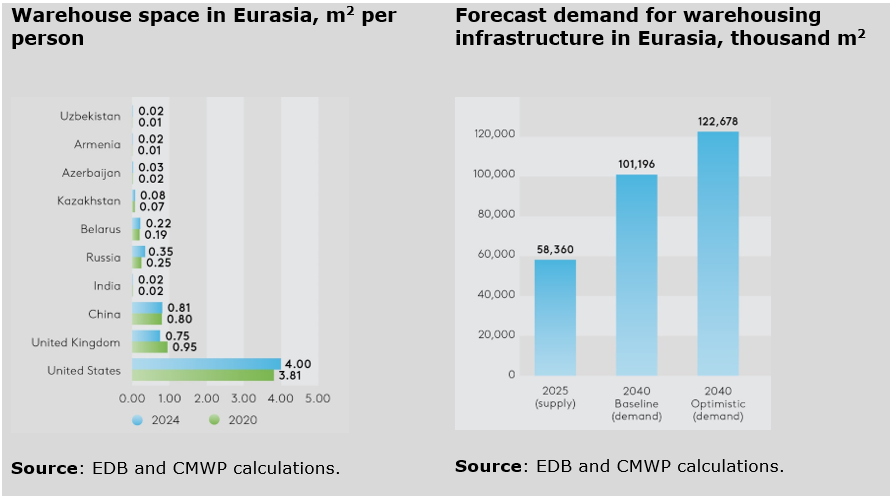

Eurasia has entered a phase of accelerated warehousing infrastructure development. From 2021 to the first quarter of 2025, the total warehouse space in the region increased from 44 to 58 million m2.

In Central Asia, the South Caucasus and Belarus, the total stock has reached 5.4 million m2.

Leaders in warehouse space:

- Belarus – 2.4 million m2

- Kazakhstan – 1.5 million sq m2

- Uzbekistan – 0.6 million sq m2

Russia has been breaking records for several consecutive years with the commissioning of new space (53 million m²).

These four countries are experiencing a significant construction boom, with some areas showing signs of market overheating. In other countries, the market is only just beginning to emerge. Per capita availability in the region (the study covers Armenia, Azerbaijan, Belarus, Georgia, Kazakhstan, the Kyrgyz Republic, Tajikistan, Turkmenistan, Russia and Uzbekistan) remains extremely low (averaging 0.23 m2 per capita). The region, which has long remained on the periphery of global logistics flows, is now shaping a new Eurasian logistics landscape. In the coming years, the market will maintain its high momentum: today, more than 20 million m2 of new warehouse space are planned for construction in the region, including around 1.6 million m2 in Central Asian countries.

New geography of trade and catching-up growth

The rapid transformation is being driven by emerging trends in trade and technology, reinforced by catching-up growth. Since 2022, the geography of global trade has shifted, and Eurasia has become one of the main beneficiaries of these changes.

The EDB forecasts that the region’s foreign trade will increase:

- from 1,278 million tonnes in 2023

- to 1,420–1,809 million tonnes by 2040.

In addition, the composition of cargo flows is changing in favour of non-commodity goods. This requires the active development of:

- multimodal hubs

- dry ports

- border logistic hubs

- large distribution warehouses along international transport corridors

Evgeny Vinokurov, Chief Economist at the EDB:

“Logistics and warehousing operations account for up to a quarter of the value added in global value chains. Unlocking the potential of warehousing infrastructure is not about square metres but about high economic competitiveness. Modern warehouses reduce logistics and transaction costs, accelerate trade turnover, integrate companies into regional value chains and create new centres of gravity for production. Modern warehousing is a high-tech business with potential for AI and robotisation. In the context of accelerated industrialisation and structural shifts in consumption – from the rapid development of e-commerce to growing demand for cold and specialised storage – the sector will become one of the growth drivers.”

E-commerce as a long-term driver

By 2040, the share of online commerce in retail turnover could reach 20–25% across the region (compared with 20% in Russia and 3% in Uzbekistan in 2024).

This is driving the growth of investment in:

- fulfilment centres

- last-mile urban warehouses

- logistics automation

Large retailers are increasingly outsourcing logistics, and demand for 3PL providers is rising rapidly, particularly in the e-commerce and FMCG segments. Against this backdrop, a new generation of logistics companies is emerging, developing multifunctional complexes designed to serve several clients simultaneously. In these conditions, requirements for service quality and the technological sophistication of warehouses are increasing.

Other drivers include the digitalisation of logistics, accelerating industrialisation and the development potential of the agro-industrial sector. As a result, the structure of demand is gradually shifting towards specialised warehouses – refrigerated, pharmaceutical and next-generation logistics hubs that meet automation and energy efficiency standards.

Forecast to 2040: doubling of demand

The EDB estimates that demand for modern warehouse space in the region could almost double, reaching 101–123 million m2 by 2040.

Expected demand by segment:

- 73–87 million m2 – retail (quality dry ports)

- 23–27 million m2 – e-commerce (fulfilment centres, distribution warehouses, urban logistics)

- 4.7–7 million m2 – agribusiness (including refrigeration facilities and agricultural logistics facilities)

- 1.3–1.6 million m2 – pharmaceuticals (including GMP-class and regional distribution hubs)

- 4–4.3 thousand hectares – transport (transhipment terminals, container and open areas)

What is needed to realise the potential

To unlock the potential of the warehousing sector, EDB experts highlight the need for coordinated action by governments, businesses and international institutions. The top priority is to create a unified institutional environment that enhances investment attractiveness and market transparency.

Key measures:

- Unifying standards and harmonising customs procedures

- Implementing digital platforms and logistics management systems

- Accelerating the construction of distribution centres and specialised facilities for agricultural and pharmaceutical products, multimodal hubs and dry ports at transport corridor nodes

- Developing PPP mechanisms, collective financing instruments and infrastructure bonds

- Stimulating investment through tax incentives

- Enhancing human resource development

Green energy efficiency standards and ESG principles are becoming increasingly important. Their implementation will reduce costs, increase the sustainability of logistics chains and attract long-term institutional investors.

Implementing these measures will help eliminate existing bottlenecks in Eurasia’s warehousing infrastructure. A modern Eurasian transport and logistics network will connect key economic centres and support the continued growth of trade flows in the new geoeconomic reality. This will create a solid foundation for integrating the region into global supply chains and unlocking its economic potential.

The report Warehousing Infrastructure in Eurasia: An Opportunity of the Decade is available on the Bank’s website.

Additional Information:

The Eurasian Development Bank (EDB) is a multilateral development bank investing in Eurasia. For more than 19 years, the Bank has worked to strengthen and expand economic ties and foster comprehensive development in its member countries. By July 2025, the EDB’s cumulative portfolio comprised 319 projects with a total investment of US $19.1 billion. The portfolio consists principally of projects with an integration effect in transport infrastructure, digital systems, green energy, agriculture, manufacturing and mechanical engineering. The Bank adheres to the UN Sustainable Development Goals and ESG principles in its operations.

The EDB is implementing three mega-projects as part of its 2022–2026 Strategy: the Central Asian Water and Energy Complex, the Eurasian Transport Network and the Eurasian Agricultural Goods Distribution System.

The EDB Media Centre:

+7 (727) 244 40 44, ext. 4774 and 2160