The EDB monitoring: The Direct Investment Stock by China, Türkiye and the Gulf States in the Eurasian Region Reached $87 bn

Greenfield projects are a priority form of investments made by non-member countries. As of mid-2024, the total value of such projects in the Eurasian region amounted to $57 bn.

Almaty, February 19, 2025. The new EDB study is a continuation of the report "EDB Monitoring of Mutual Investments – 2024. Eurasian Region" published in December 2024 and dedicated to investments between Eurasian countries.

The new EDB study analyses mutual investments of 13 countries located in the Eurasian region (Azerbaijan, Armenia, Belarus, Georgia, Kazakhstan, Kyrgyzstan, Moldova, Mongolia, Russia, Tajikistan, Turkmenistan, Uzbekistan, Ukraine) and external partner countries (China, Türkiye, Iran and the Gulf states). The report contains an analysis of the scale, dynamics, geographical and sectoral structure of mutual investment stock.

The EDB`s Monitoring of Mutual Investments (hereinafter - EDB's MMI) is based on a database of mutual investments made over the period of 2016 – mid-2024. The database is formed using a bottom-up approach and is based on the analysis of inter-country projects using comprehensive data from public sources. The EDB's MMI allows for accounting for investments made through offshore companies and is a valuable addition to the official statistics presented by central banks.

China, Türkiye and the UAE are the leaders among the countries exporting investments in the Eurasian region

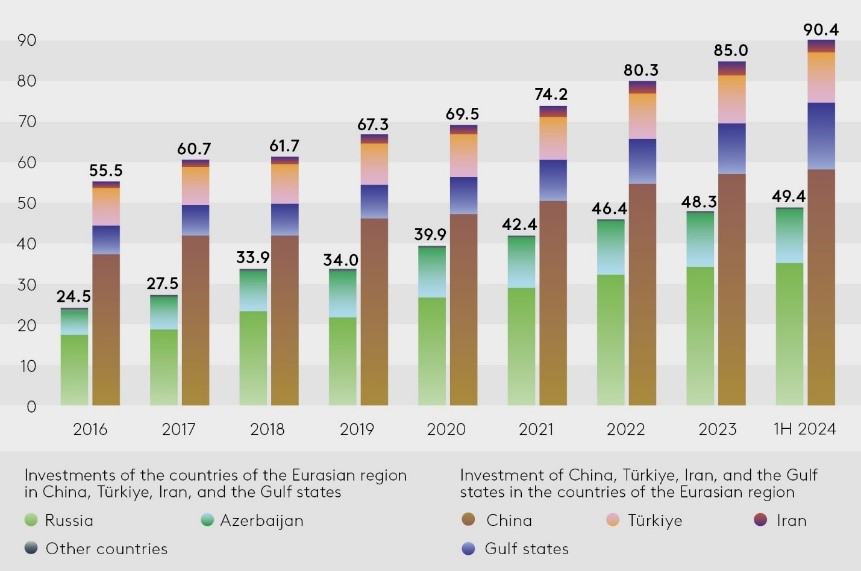

By mid-2024, the volume of investment stock from China, Türkiye, Iran and the Gulf states in the countries of the Eurasian region reached $90.4 bn, an increase of 6.4% compared to 2023.

China is the largest exporter of investments in the Eurasian region. By mid-2024, China's direct investment stock amounted to $58.6 bn (i.e. 64.8% of the total amount), followed by Türkiye ($12.3 bn or 13.6%), the United Arab Emirates ($12.2 bn or 13.5%), Iran ($3.2 bn or 3.5%), Saudi Arabia ($2.3 bn or 2.5%) and Qatar ($1.6 bn or 1.8%).

Iran demonstrated the highest growth rate with regard to the investments in Eurasia (compared to 2016, this amount doubled), with Azerbaijan being the key investment destination (90% of the total investments). Türkiye’s investments have the lowest growth (by 1.3 times), but they are characterised by broad industry diversification based on investment stock. The new investors in the region are Saudi Arabia and Qatar, their first investments made in 2021 and 2024, respectively.

The main recipients of investments from external partner countries are Russia ($23.5 bn or 26%), Turkmenistan ($17.5 bn or 12.5%), Kazakhstan ($15.5 bn or 11.1%), Mongolia ($10.3 bn or 7.4%) and Uzbekistan ($8.8 bn or 6.3%).

Central Asian countries account for 51% of the entire volume of investments in the Eurasian region made by China, Türkiye, Iran and the Gulf states. Over 18 months, this share increased by 5 p.p., while the volume of investments increased by 25%, to constitute $46.2 bn.

The amount of investments made in the Eurasian region exceeds the amount invested by the region itself

The outgoing investment stock made by the countries of the Eurasian region in the partner countries amounted to $49.4 bn, which is twice as high as in 2016.

Türkiye receives 80% of all investment stockof external partner countries and is the only country with a negative balance in mutual investments with the countries of the Eurasian region. It accounts for $27.9 bn ($12.3 bn of investment outflow; $40.2 bn of investment inflow). A significant part of projects with investments in Türkiye are implemented with the participation of Russian capital.

Direct investment stock between the Eurasian region and external partner countries, $ bn

Source: EDB MMI database

Source: EDB MMI database

China is increasing investments in energy and manufacturing

China's investments are traditionally concentrated in the extractive industries ($36.2 bn). Compared to 2020, however, the sector share decreased by 7.7 p.p. to constitute 61.7% by mid-2024, due to the active growth of China's investments in energy and manufacturing. Over 18 months, its investments in the electric power industry increased to $4.1 bn (i.e. by 2.1 times), 85% of them directed to Uzbekistan (solar and hydroelectric power plants). Investments in the manufacturing sector increased to $11.8 bn (i.e. by 8%) over the same period. 97% of the investments went to Central Asia: the recipients included an automobile plant in Uzbekistan and a porcelain stoneware factory in Kazakhstan.

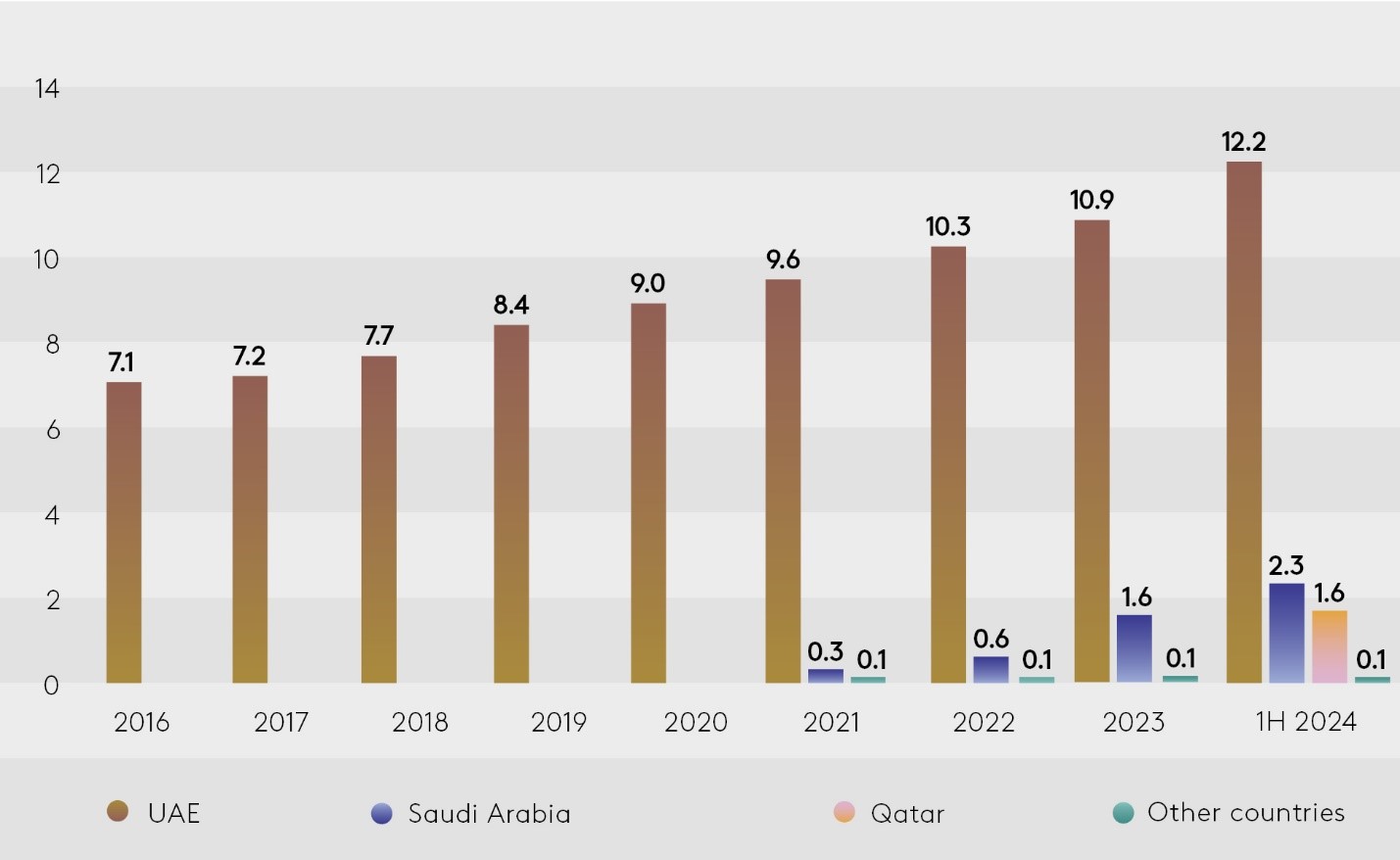

The Gulf states are increasing their investments in the Eurasian region at an intensive rate, with the priority being given to Central Asia

In terms of investments in the Eurasian region, the UAE is the leading Gulf state. Since 2016, the volume of investments has increased by 1.7 times and amounted to $12.2 bn by mid-2024; 90% of the amount went to Central Asia. The main investment areas are: field development in Turkmenistan ($8 bn), Uzbekistan's electric power industry ($1.7 bn), and construction sectors of Kazakhstan and Georgia ($1.6 bn).

Direct investment stock of the Gulf states in the Eurasian region, $ bn

Source: EDB MMI database

Source: EDB MMI database

Saudi Arabia and Qatar are new investors in the Eurasian region. Saudi Arabia's investments increased from $0.3 bn in 2021 to $2.3 bn by mid-2024 (electric power projects in Uzbekistan). Qatar's first investment in the Eurasian region was in 2024 and amounted to $1.6 bn (a telecommunications project in Kazakhstan).

Manufacturing and energy are replacing the extractive industries in the investment stock structure

The extractive industries account for 55% of the direct investment stock ($50 bn) made in the Eurasian region by mid-2024, but its share has decreased (from 65.4% in 2020).

The manufacturing sector attracted $14.4 bn, thus accounting for a 16% share (+3.3 p.p., compared to 2020). The electric power industry is showing the most dynamic growth – by 4.8 times (compared to 2020), which is $9.1 bn, and accounts for a 10.1% share (+7.4 p.p., compared to 2020).

Greenfield projects are the main form of investments

Greenfield projects involve the creation of new enterprises and infrastructure on "vacant land." By mid-2024, the share of greenfield investments reached $57 bn, having increased by 1.9 times since 2016. The share of greenfield investments increased from 53.5% to 63% due to the intensive growth of the Central Asian economies, the demand for new projects in the real sector (extractive industries, manufacturing, energy), which account for 78% of all primary projects, as well as due to the interest that the Gulf states take in creating new enterprises in the region.

More information about the report and research materials can be found on the EDB's website.

The Eurasian Development Bank (EDB) is a multilateral development bank investing in Eurasia. For more than 18 years, the Bank has worked to strengthen and expand economic ties and foster comprehensive development in its member countries. The EDB's charter capital totals $7 bln. Its portfolio consists principally of projects with an integration effect in transport infrastructure, digital systems, green energy, agriculture, manufacturing, and mechanical engineering. The Bank’s operations are guided by the UN Sustainable Development Goals and ESG principles.

The EDB Media Centre:

+7 (727) 244 40 44, ext. 6148 and 3730