The EDB presented a study on the activities of international financial institutions in the Kyrgyz Republic

Almaty, December 11, 2024. One of the key speakers at the strategic session held on December 3, 2024, and dedicated to the 10th anniversary of the Russian-Kyrgyz Development Fund (RKDF), was Alexey Kuznetsov, Head of Research Department at the Eurasian Development Bank (EDB), who presented the results of the joint EDB and RKDF's analytical study titled Non-Sovereign Financing by International Financial Institutions in the Kyrgyz Republic: Role of the Russian-Kyrgyz Development Fund.

The study provides a comprehensive analysis of the non-sovereign financing provided by international financial institutions (IFIs) in the Kyrgyz Republic over the past 10 years based on the information accumulated in the EDB NSF Database. The study also contains a detailed overview of the RKDF activities from the moment of the Fund's creation and up to present.

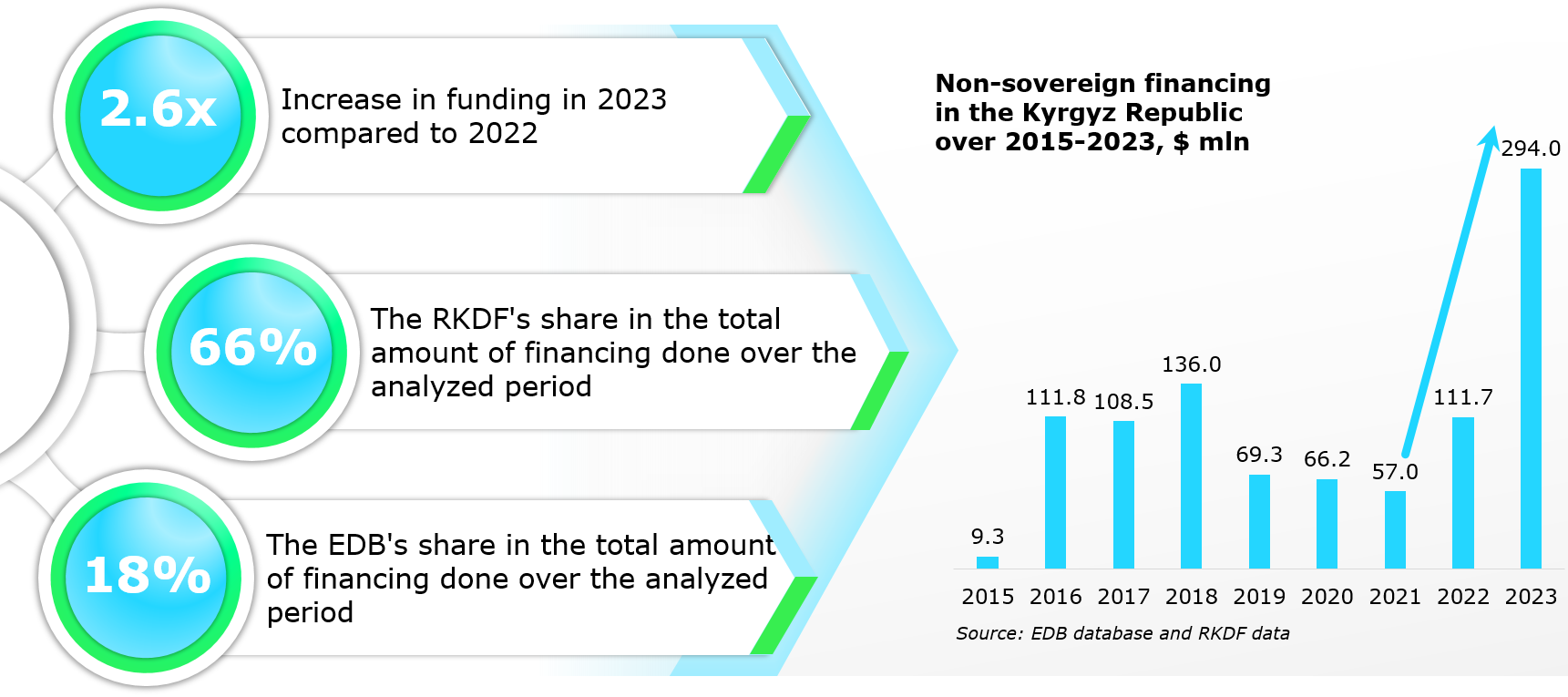

"Non-sovereign financing by international financial institutions aims to stimulate sustainable and dynamic economic development of countries and regions. This is ensured by promoting development of the private sector without burdening public finances. Over the past 10 years, non-sovereign financing by IFIs in Kyrgyzstan has amounted to about $1 bln. The EDB and the RKDF are leaders over a variety of parameters of non–sovereign financing, which indicates their important role in the sustainable development of the Kyrgyz economy," Alexey Kuznetsov noted.

Source: EDB database of IFI's non-sovereign operations and RKDF data.

The analysis of the structure of non-sovereign operations by IFIs led to the following conclusions:

- Main investors in the Kyrgyz economy are the RKDF, the EDB and the EBRD. The RKDF's share in the total amount of financing over the analyzed period amounted to 66%.

- The main sectors funded by IFIs are industry (31%), finance (24%) and agriculture (15%). This financing structure contributes to the accelerated development of the industrial base, diversification of production and country's exports.

- IFIs provide mainly investment loans (98% of all financing in 2015-2023). Other instruments of financing include equity investment, guarantees, and technical assistance.

- The share of projects financed in Kyrgyz som amounted to 22%. The share of projects with a multi-currency financing structure is 11%.

Every year the RKDF keeps maintaining its leadership position in terms of non-sovereign financing in Kyrgyzstan. In addition to loans, the Fund also offers a wide range of tools to support the private sector: financing SMEs through banks, developing financial sector, providing guarantees, technical assistance and professional advice on project financing.

The main results of the Fund's activities are as follows:

- Over the entire period of its operations, the Fund has financed 3,501 projects in Kyrgyzstan totaling $760.5 mln.

- The investment to the RKDF authorized capital ($500 mln) ratio is 152%.

- In 2023, the funding provided by the RKDF amounted to a record $159 mln, which is 2.3 times higher than in 2022. As of 1 November 2024, the RKDF loan portfolio amounted to $360 mln.

- Over the past 3.5 years (starting from 2021), the Fund has invested $390.2 mln in the Kyrgyz economy, which is 51% of the total amount of funds disbursed.

- The structure of the Fund's portfolio by sector has changed over the past 3.5 years towards an increase in the share of production and small hydropower.

In accordance with the 2023-2027 Strategy, the RKDF will continue financing projects in priority sectors of the Kyrgyz economy. The Fund is planning to invest more than $630 mln in the Republic's economy, to attract direct investment worth at least $200 mln, and to increase the Fund's loan portfolio to $600 mln by the end of 2027.

The full text of the Working Document and additional materials are available on the EDB website.

Questions or suggestions can be sent to research@eabr.org

Additional Information:

The Eurasian Development Bank (EDB) is a multilateral development bank investing in Eurasia. For more than 18 years, the Bank has worked to strengthen and expand economic ties and foster comprehensive development in its member countries. The EDB's charter capital totals $7 bln. Its portfolio consists principally of projects with an integration effect in transport infrastructure, digital systems, green energy, agriculture, manufacturing, and mechanical engineering. The Bank’s operations are guided by the UN Sustainable Development Goals and ESG principles.

The EDB Media Centre:

+7 (727) 244 40 44, ext. 6148 and 3730