Carbon Pricing Policy Opportunities in Central Asia and Azerbaijan

Carbon pricing is one of the most effective and widespread climate incentives, with 75 carbon pricing instruments (CPIs) in operation worldwide. The countries of Central Asia and Azerbaijan have different approaches to CPI implementation, ranging from having an ETS in place to carrying out initial discussions. Joint report by the Eurasian Development Bank (EDB) and the CAREC Institute (CI) provides a comprehensive analysis of the current status, prerequisites and prospects of carbon pricing instruments in Azerbaijan, Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan. The report also presents a Readiness Assessment Tool to facilitate the decision-making in this field, and makes recommendations to policymakers to help design an appropriate climate policy mix.

30 September 2025

Carbon pricing is one of the most powerful climate-related policy instruments to reduce carbon emissions in a flexible way. While serving its primary goal of climate change mitigation, when implemented effectively it can also generate revenue that can be reinvested to promote green technologies and provide market participants with more clarity and predictability about emissions levels, supporting long-term planning and decision making. Initially more widespread in high-income economies, carbon pricing mechanisms are now also increasingly being adopted in middle-income countries, reflecting a global shift toward more inclusive climate engagement.

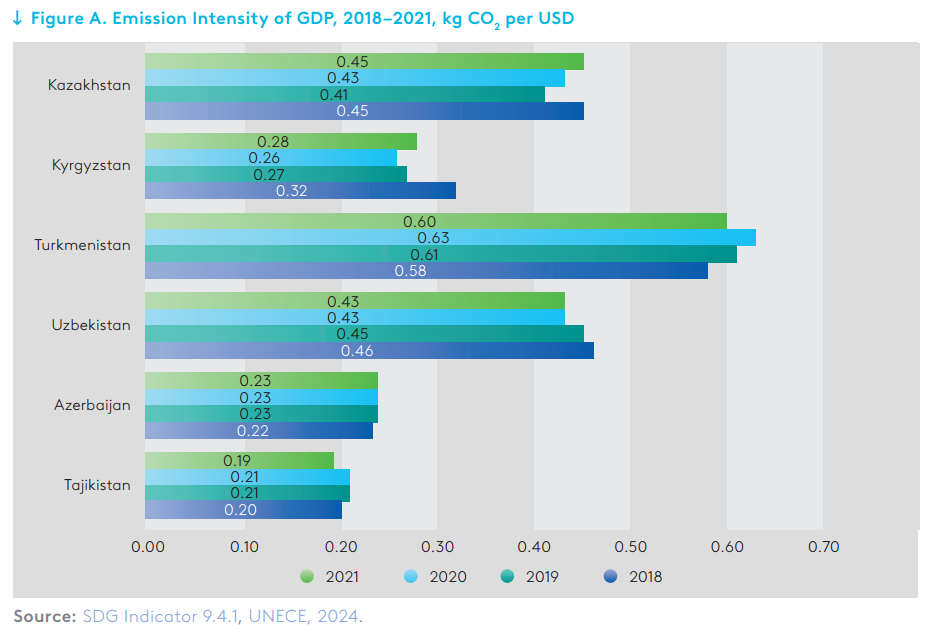

The share of countries of Central Asia (Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan) and Azerbaijan in global greenhouse gas (GHG) emissions is very small (1.4%), with Kazakhstan and Uzbekistan having the highest share in the region (0.73% and 0.32%, respectively). The share of these countries in global GDP and population is even smaller: 0.87% and 1.08%, respectively. In terms of carbon intensity per GDP, Turkmenistan has the highest value among the countries considered (0.60 kg CO2 per USD). Although these ratios may seem negligible on a global scale, the region’s collective contributions could play a crucial role in global climate efforts and sustainable economic growth.

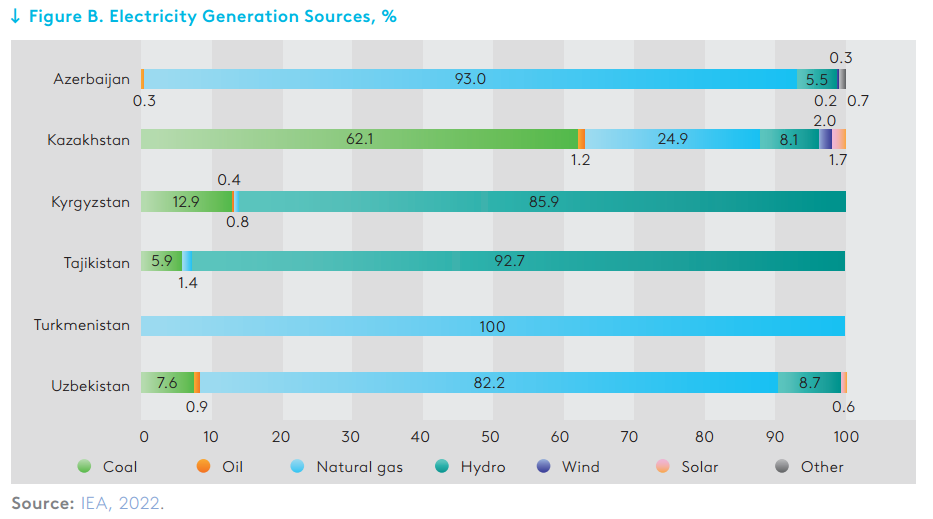

The energy sector is responsible for the largest share of carbon emissions in all countries of the region except Kyrgyzstan and Tajikistan, where agriculture is the largest emitting sector. Azerbaijan, Kazakhstan, Uzbekistan, and Turkmenistan have a larger footprint due to their dependence on coal and natural gas for power generation, industry, and transportation, while Kyrgyzstan and Tajikistan have the largest share of renewables in power generation – 67.9% and 87.2%, respectively. This sharp contrast reflects the region’s economic diversity and emphasizes the importance of context-specific climate policies.

Central Asian countries and Azerbaijan are actively integrating climate-related provisions in their policies, considering international agreements and tailoring best practices to national conditions and priorities. All countries in the scope of this research have developed Nationally Determined Contributions (NDCs). The countries also recognize development and expansion of renewable energy sources as priorities of climate policy. Kazakhstan and Kyrgyzstan have taken decisive action by committing to net-zero emissions targets, showcasing their ambition to lead the climate agenda in the region. Tajikistan carved out a unique approach, being the only country in the scope of this research that prioritizes adaptation over mitigation, addressing its vulnerability to climate impacts.

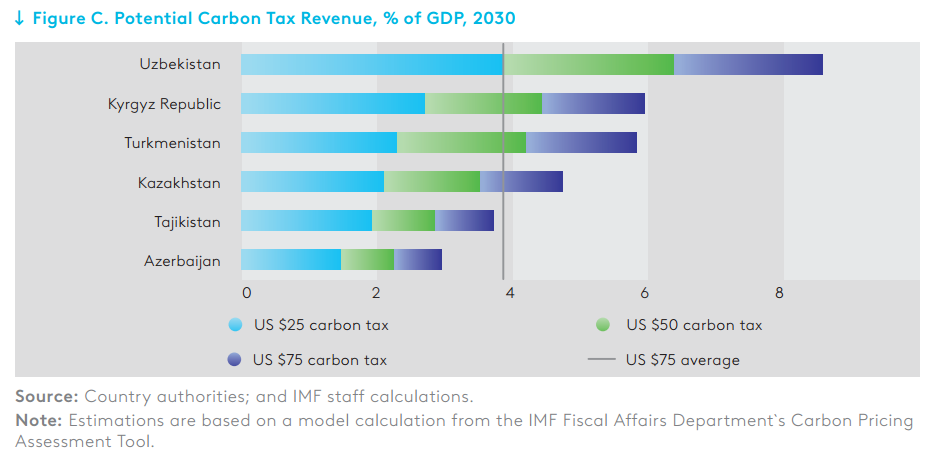

CPIs are considered to be a power tool to meet the NDCs as well as a source of additional revenue. According to the IMF, the current mitigation policy mix in Azerbaijan, the Kyrgyz Republic, and Kazakhstan may not be sufficient to curtail emissions to their target, while Uzbekistan and Tajikistan appear to be on track to meet their unconditional commitments. The IMF assesses that the weighted average NDC emissions target in the Caucasus and Central Asia can be met with a uniform US$25 per tonne of CO2 carbon tax on average, which could generate about 2.6% of GDP in revenue in the Caucasus and Central Asia. Nevertheless, the possible downsides for businesses and households from introducing the carbon tax of this value should be also considered case by case.

The deployment of CPIs presents significant challenges, as it requires robust policy and regulatory frameworks as well as institutional capacity. Effective administration, monitoring, rules-setting mechanisms, defined targets and timelines are critical to achieving emissions reduction. Equally important is the support of stakeholders, as public perception of carbon pricing could be mixed. Among all the countries in the scope of the research, only Kazakhstan has a CPI in place. Azerbaijan signaled the development of a Zero Emissions Development Strategy that could include carbon tax as one incentive. Uzbekistan is taking incremental steps towards carbon pricing by building the necessary infrastructure and institutions. The reasons for both common and different practices lie in the diverse economic structures and GHG emissions profiles, when some factors defining the country’s readiness to introduce carbon pricing require additional examination prior to decision-making, ensuring that future CPIs are both feasible and impactful.

The Readiness Assessment Tool was developed to assess a number of factors that could influence the importance of carbon pricing for achievement of a national climate target, the country’s readiness for fiscal climate regulation, and the potential effectiveness of such an instrument in the national context. It includes such country-specific criteria as economic and emissions profiles, climate policy focus and level of NDC, current policy gaps and overlaps, Measurement, Reporting, and Verification (MRV) systems, the existing carbon markets track record, institutional capacity, and efficiency of stakeholder engagement.

An analysis of the Central Asian countries and Azerbaijan demonstrates that the CPI is not a “one-size-fits-all” approach, underscoring the need for tailored strategies to maximize the value and impact they would generate for the country. For example, Azerbaijan could increase the competitiveness of its exports and pave the way for the diversification of its carbon-intensive economy by introducing fiscal carbon measures. Kazakhstan’s unique position and low-carbon ambitions demonstrate the importance, efficiency, and readiness of carbon pricing. The same could be true for Uzbekistan, which already meets many of the prerequisites for efficient carbon pricing. Meanwhile, Kyrgyzstan and Tajikistan could explore other green growth opportunities sufficient to reach their NDCs. Turkmenistan currently lacks the fundamental elements of climate regulation, rendering the implementation of carbon pricing premature, particularly in light of substantial fossil fuel subsidies.

According to the common and different features of the countries in the scope of this research, as well as the challenges that could arise when designing carbon policy, the following steps can be recommended when considering introduction of a CPI:

- First, to conduct a readiness assessment to identify the level of development of the carbon pricing policy, mechanisms and instruments, and technical readiness required in each country. This stage also includes establishing an institutional MRV system that would be beneficial to any climate policy. A country should also assess how fossil fuel subsidies could be gradually phased out while also ensuring safety net to the most vulnerable population.

- Second, if the preparatory work indicates a need and readiness of a country to implement CPIs, carbon pricing enablers should be strengthened. This stage could include alignment of carbon pricing policies with complementary country’s policies as well as harmonization of the CPI frameworks with the national and regional context. It is also important to provide institutional capacity-building for efficient carbon pricing, as it requires additional efforts and skills for administration. Additionally, stakeholder engagement and public awareness to gain public buy-in will secure longer-term policy stability.

- Third, regardless of whether carbon pricing is considered premature or unnecessary at the current stage of climate policies, a country could still unlock a wide range of complementary instruments to promote low-carbon growth. These instruments could include feed-in-tariffs incentivizing renewable energy investments, mechanisms for emission reduction or tradable carbon credits, and international funding opportunities via development banks, funds, and other agencies. Such tools could serve as effective transitional decarbonization measures that would be added to future carbon pricing systems.