The Eurasian Region and Partner Countries in Asia: Analysis of Investment Flows based on EDB Monitoring of Mutual Investments

-

Report

PDF, 2.29 Mb -

Key Findings

PDF, 5.10 Mb -

Summary

PDF, 717.53 Kb -

Presentation

PDF, 6.64 Mb

The total stock of mutual investments between countries of the Eurasian region and partner countries in Asia reached a record US $176 billion. It has been growing steadily since 2016 and has doubled over the past ten years.

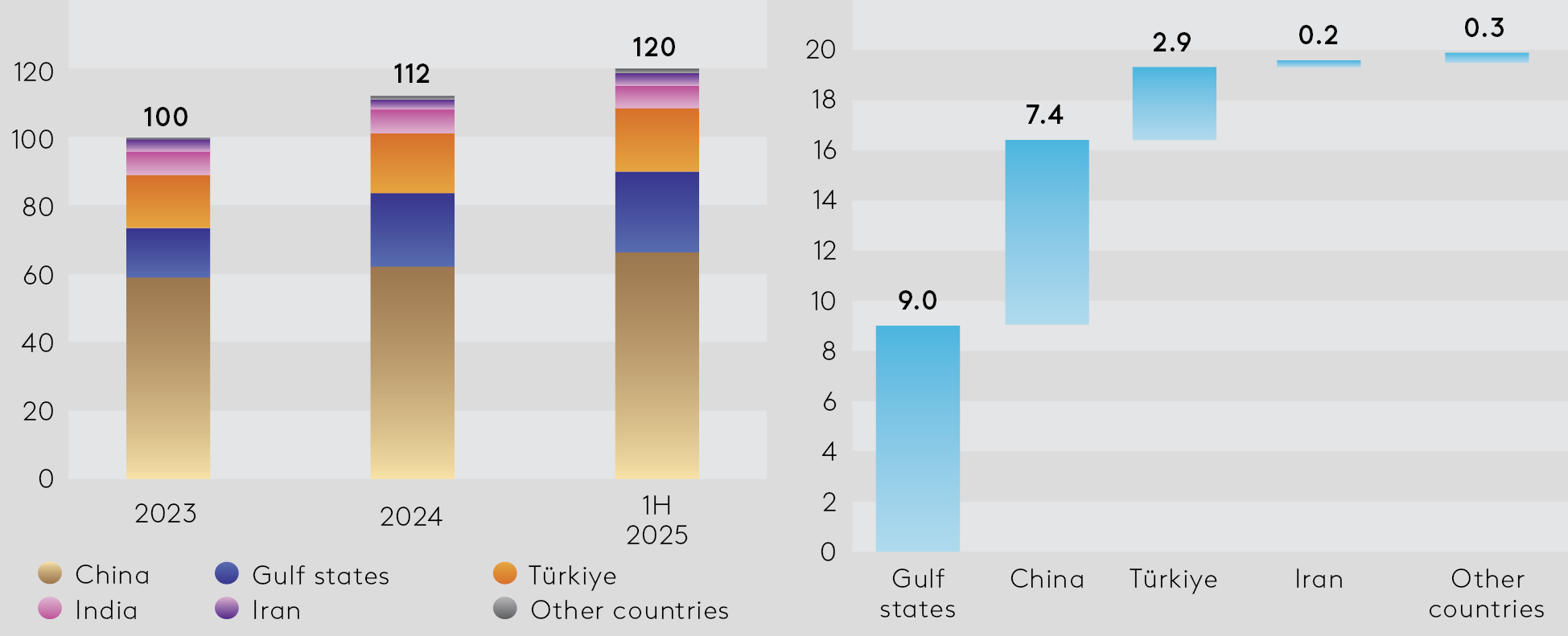

By mid-2025, total FDI stock attracted to the Eurasian region from Asian countries reached US $119.8 billion, representing a 20% increase compared to 2023.

China remains the largest investor in the Eurasian region, while the Gulf states have played a pivotal role in driving investment growth in recent years. They made the largest contribution to investment growth over the past year and a half. Of the total increase in investment from Asian countries of US $20 billion, the Gulf states accounted for about US $9 billion, or 45%. Over the long term, they have demonstrated the highest investment growth rates in the Eurasian region, averaging 13.9% per year since 2016.

Investment stock from Asian countries in the Eurasian region (left) and investment growth by investor country from 2023 to the first half of 2025 (right), $ billions

Source: EDB MMI database

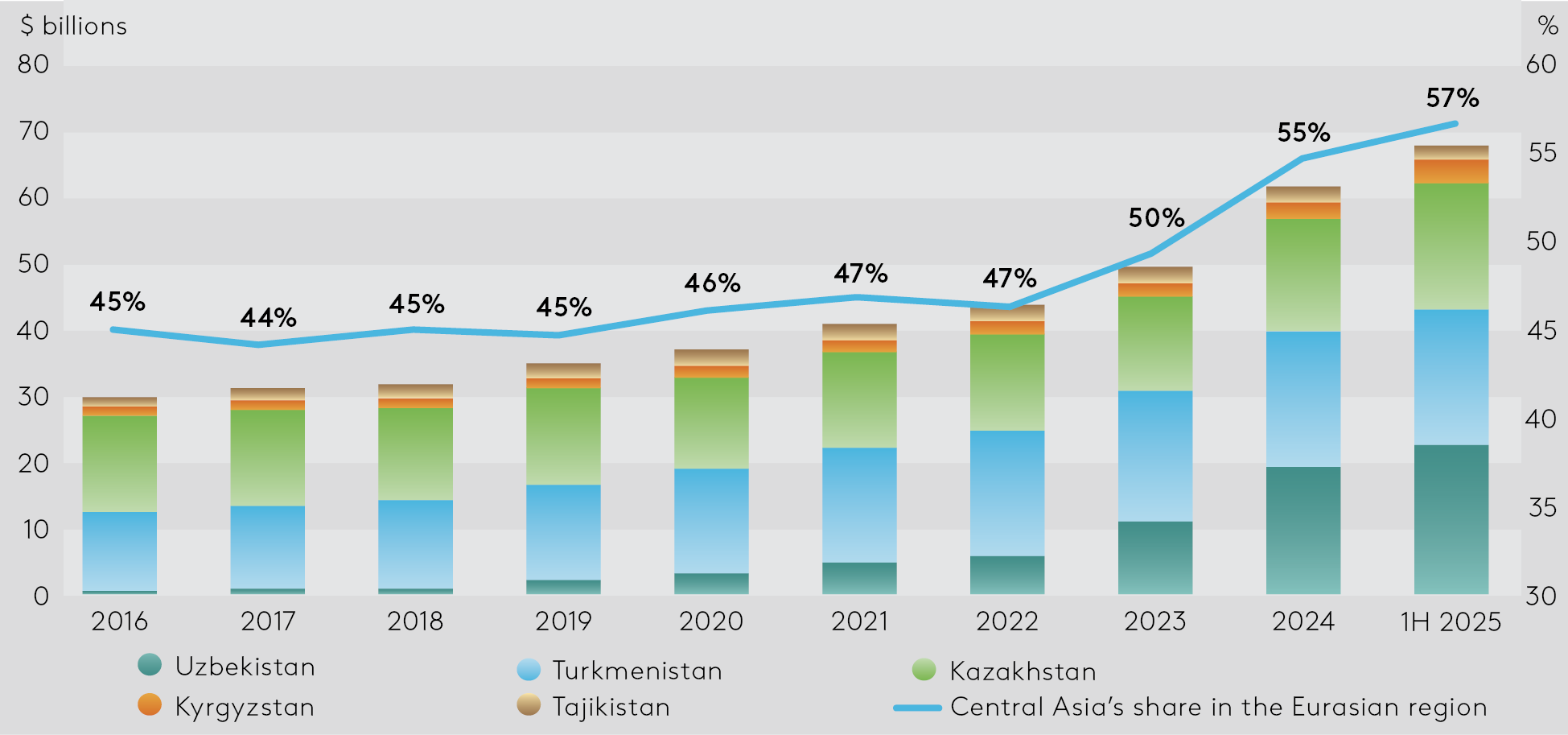

Central Asia is a particularly attractive destination for Asian investors. Investment stock from Asian countries into Central Asian economies between 2016 and the first half of 2025 increased 2.3 times, from US $29.9 billion to US $68 billion. By the end of the first half of 2025, Central Asia accounted for up to 57% of the total direct investment stock attracted from Asian countries.

The volume of attracted investments by the mid-2025 was distributed as follows: Uzbekistan ($22.6 billion), Turkmenistan ($20.6 billion), Kazakhstan ($19.3 billion), Kyrgyzstan ($3.2 billion) and Tajikistan ($2.4 billion).

Investment stock from Asian countries in Central Asia

Source: EDB MMI database

A steady structural shift is under way away from the dominance of extractive industries towards a more diversified investment model. By mid-2025, manufacturing accounted for 23% of mutual FDI stock, becoming a key driver of industrial cooperation in the Eurasian region.

Over the past decade, the investment landscape of the Eurasian region has changed significantly, with the share of the power sector rising sharply from 2% to 17%. In the past year and a half alone, power generation projects accounted for more than half of total growth in investment attracted to Eurasian countries (US $10.1 billion out of US $19.8 billion). The Gulf states and China are the most active investors in the power sector, including renewable energy.

The acceleration of FDI inflows into the power sector reflects a combination of factors, including rapid growth in domestic electricity demand and the accelerating energy transition in Eurasia, supported by renewable energy projects.