Macroeconomic Outlook 2025-2027

-

Full text

PDF, 3.45 Mb -

Summary

PDF, 681.99 Kb -

Presentation

PDF, 19.35 Mb -

Conclusions

PDF, 252.62 Kb

This marks the first presentation of macroeconomic projections for Uzbekistan. By the time Uzbekistan joined the EDB member countries, the Bank had developed and implemented a modelling toolkit enabling comprehensive analysis of macroeconomic trends and medium-term forecasting for its newest member.

EDB analysts outline major global economic trends and their implications for Eurasia. Global growth is expected to slow to 3% in 2025, down from 3.3% in 2023–2024. Heightened uncertainty stemming from US tariff policy and structural challenges will restrain global economic activity. In the US, declining consumer confidence and weak business sentiment are anticipated to slow GDP growth to 1.4 % in 2025, compared to 2.8 % in 2024. Growth in the euro area is expected to remain subdued at around 0.6 %, following 0.9 % the previous year. Reduced external demand amid trade tensions will constrain growth potential. Meanwhile, China’s economy is projected to sustain growth near 5% in 2025, supported by government measures to stimulate domestic demand.

Inflation in developed economies is forecast to accelerate further in 2025 due to higher costs from tariff increases. However, with weaker economic dynamics, the Federal Reserve rate is expected to decline from 4.25–4.50% in June to around 4% by year-end, while the ECB rate is projected to hold steady at 2% through the end of 2025.

Despite a challenging external environment, economic activity in EDB member countries is forecast to remain strong in 2025. Growth will continue to be powered by domestic sources, primarily investment in infrastructure and industry, alongside robust consumer demand driven by rising household incomes. EDB analysts estimate regional GDP growth of 2.7% in 2025, with inflation easing to 7.7%, down from 8.8% in 2024.

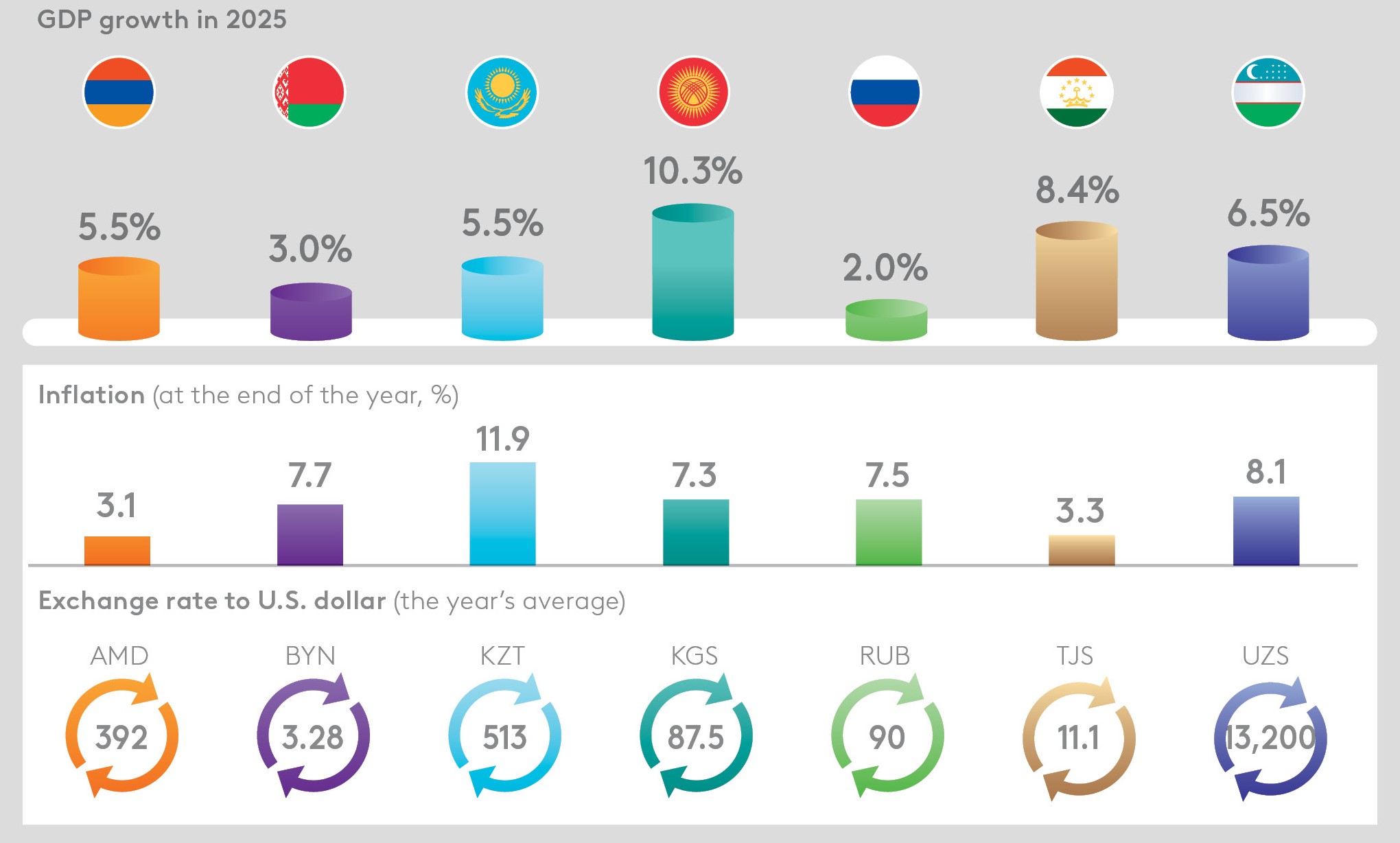

Key macroeconomic projections for EDB member states in 2025

Source: EDB analysts’ calculations

According to the EDB’s projections, Armenia is expected to sustain a 5.5% growth rate, underpinned primarily by domestic demand. Inflation is forecast at 3.1% by the end of 2025, remaining near target over the entire period. The average exchange rate is projected at AMD 392 per US dollar, supported by increased proceeds from tourism exports and remittances.

Belarus has seen its 2025 GDP forecast raised by 0.4 percentage points to 3.0%, driven by strong early-year performance and the expected expansion in investment credit. Inflation is projected to reach 7.7% amid domestic demand pressures, inflation spillovers from Russia, and gradual deregulation. The average exchange rate is projected at BYN 3.28 per US dollar, with some depreciation in the latter half of the year due to foreign trade deficits and an anticipated return of the Russian rouble above RUB 90 to the dollar.

Kazakhstan’s growth is projected to quicken to 5.5%, up from 4.8% in 2024. Large-scale support for investment projects equivalent to 6% of GDP will counter external pressures. Growth drivers include fiscal stimulus, increased oil production, and initiatives focused on regional development and infrastructure. With strong consumer demand and higher utility tariffs, inflation is forecast to reach 11.9% in 2025. According to EDB analysts’ projections, the tenge is expected to remain stable until the end of the year, averaging KZT 513 and ending the year at KZT 515 per US dollar, backed by a high key rate and the expected increase in oil exports in the latter half of the year following the launch of the Tengiz field expansion.

Kyrgyz Republic sees its 2025 GDP forecast increase by 1.6 percentage points to 10.3%, driven by rising gold prices, household consumption and investment demand. Year-end inflation is expected to align closely with the 7.3% YoY target. Over the rest of 2025, the exchange rate is projected to remain largely unchanged, averaging KGS 87.5 per US dollar, supported by growing export revenues amid favourable global gold prices and moderation in import growth.

Russia’s economy is forecast to slow gradually to 2.0% in 2025 following a period of strong growth, as domestic demand begins to cool. A prolonged spell of high interest rates and rouble appreciation in the first half of the year is expected to bring inflation down to 7.5% by year-end, compared with 9.5% in 2024. EDB analysts anticipate that the Russian rouble will weaken in the second half of the year, reaching RUB 95 per US dollar by the end of 2025. Although high interest rates will continue to support the national currency, declining oil prices and reduced export volumes will limit the supply of foreign exchange in the market.

Tajikistan’s GDP is projected to grow by 8.4% in 2025. Strong domestic demand and a favourable external trade environment – particularly rising gold prices – are expected to sustain GDP growth at 20-year highs. Inflation is forecast at 3.3% YoY by the end of 2025, remaining within the target range.

According to the EDB’s first Macroeconomic Outlook covering Uzbekistan, the country’s economy is forecast to expand by 6.5% in 2025. Steady GDP growth will be underpinned by rising household incomes and an active investment policy aimed at fostering sustainable development. Earlier monetary policy measures are expected to help reduce inflation to 8.1% by year-end. EDB analysts project that the average annual UZS exchange rate will be around 13,200 per US dollar in 2025. The national currency will be supported by increased remittance inflows and consistent growth in export earnings.