Warehouse Infrastructure in Eurasia: Opportunity of the Decade

-

Report

PDF, 10.45 Mb -

Presentation

PDF, 5.78 Mb -

Summary

PDF, 550.75 Kb -

Key findings

PDF, 842.50 Kb

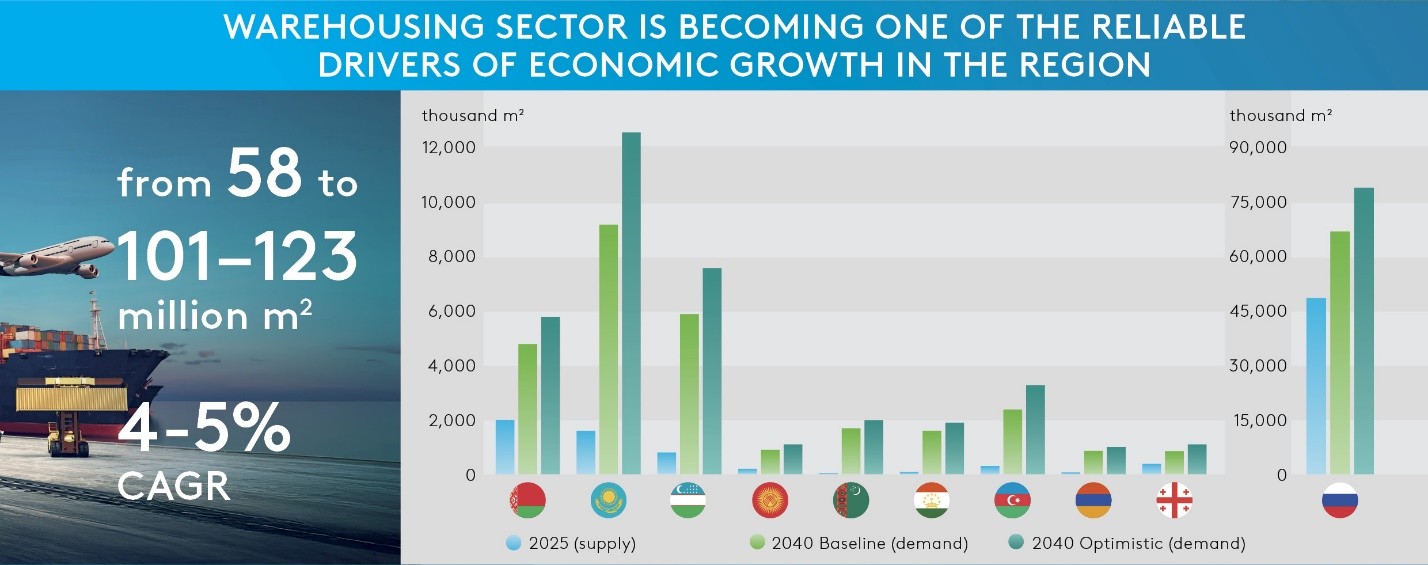

The warehouse sector in Eurasia is experiencing rapid development. From 2021 to Q1 2025, the total warehouse space in the region increased from 44 to 58 million square metres.

In Central Asia, the South Caucasus, and Belarus, the total stock reached 5.5 million m².

The leaders in terms of total warehouse space are Russia (53 million m²), Belarus (2 million m²), Kazakhstan (1.6 million m²) and Uzbekistan (0.8 million m²). These four countries are experiencing a significant construction boom. Russia has been breaking records for several consecutive years with the commissioning of new space. In other countries in the region, the market is only just beginning to emerge. The per capita supply indicators in the region (the study includes Azerbaijan, Armenia, Belarus, Georgia, Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, Russia and Uzbekistan) are extremely low (averaging 0.23 m² per capita). The region, which has long remained on the periphery of global logistics flows, is now shaping a new Eurasian logistics landscape. In the coming years, the market will maintain its high momentum: today, more than 20 million square metres of new warehouse space are planned for construction in the region, including around 1.6 million square metres in Central Asian countries.

The rapid transformation of the warehousing sector is being driven by new trends in trade and technology, which are particularly evident against the backdrop of an unmet structural deficit. After 2022, the geography of world trade began to change. According to EDB forecasts, the growing volume of foreign trade will increase from 1,278 million tonnes in 2023 to between 1,420 and 1,809 million tonnes by 2040. This requires the development of new multimodal hubs, “dry ports”, border logistics hubs, and large distribution warehouses at the intersection of international highways and along transit corridors. Increased trade with countries in the Asia-Pacific region and the Middle East is driving demand for logistics infrastructure in Central Asia, the South Caucasus and Russia's Urals, Siberia and Far East regions.

The rapid transformation of the warehousing sector is being driven by new trends in trade and technology, which are particularly evident against the backdrop of an unmet structural deficit. After 2022, the geography of world trade began to change. According to EDB forecasts, the growing volume of foreign trade will increase from 1,278 million tonnes in 2023 to between 1,420 and 1,809 million tonnes by 2040. This requires the development of new multimodal hubs, “dry ports”, border logistics hubs, and large distribution warehouses at the intersection of international highways and along transit corridors. Increased trade with countries in the Asia-Pacific region and the Middle East is driving demand for logistics infrastructure in Central Asia, the South Caucasus and Russia's Urals, Siberia and Far East regions.

The second powerful driver is the rapid growth of e-commerce. By 2040, the share of online trade in retail trade will reach 20–25% in key regional economies. This will stimulate investment in specialised fulfilment centres and networks of last-mile urban warehouses, as well as the mass automation of logistics processes. Concurrently, large retailers are downsizing their warehouse space and outsourcing logistics, resulting in a rapidly growing demand for 3PL providers' services, particularly in the e-commerce and everyday goods sectors. This is encouraging the development of professional logistics companies that are constructing multifunctional complexes to serve multiple clients simultaneously. The region is also experiencing accelerated industrialisation and an increase in the containerisation of freight flows. There is also growing demand for high-quality logistics services and technical equipment in warehouses.

All of these factors are creating an unprecedented demand for modern warehouses in almost all countries and key market sectors. The long-term forecast indicates that demand for warehouse space in the Eurasian region will almost double by 2040, growing from 58 million m² at the beginning of 2025 to between 101 and 123 million m². This equates to an average annual growth rate of 4–5%, which is significantly higher than economic growth. This reflects the effect of structural shifts and the catch-up development of logistics. In the long term, the main drivers of demand will be e-commerce and retail (fulfilment centres, distribution warehouses and last-mile networks), agribusiness (cold storage and logistics for agricultural products), the pharmaceutical sector (specialised hubs for pharmaceutical products that meet international GMP standards) and growth in transit transport and outsourced logistics (3PL).

In order to realise the potential of the Eurasia's warehouse infrastructure, EDB experts are urging governments, businesses and international institutions to take coordinated action. The main priority is to create a unified institutional environment that increases the sector's investment attractiveness and simplifies logistics operations. Key measures include introducing common warehouse standards, harmonising customs procedures, developing a digital logistics management ecosystem and smart warehouses, accelerating the construction of distribution centres and niche facilities for the agricultural and pharmaceutical sectors, and creating multimodal hubs and dry ports at key transport corridor locations. Particular attention should be paid to stimulating investment through PPPs, tax incentives, build-to-suit models and infrastructure bonds, as well as to developing human resources and creating industry coordination institutions. Another important area is introducing green energy efficiency standards and ESG approaches, which will reduce costs, boost the sector's sustainability and attract long-term investors.

Implementing this set of measures will enable Eurasia to eliminate existing warehouse infrastructure bottlenecks and ensure long-term growth. A modern Eurasian transport and logistics framework will connect key economic centres and support growth in trade flows within the new geo-economic landscape. This will establish a robust foundation for the region's integration into global supply chains and unleash its economic potential.