Cross-Border Cooperation between Russia, Belarus and Ukraine

-

Summary

PDF, 1.10 Mb

Cooperation between 27 cross-border regions of Belarus, Russia and Ukraine has significant potential; however the existing frontiers and barriers are a significant factor that fragments the region’s economic space. As a result, trade between Russian and Belarusian regions remains significantly weaker than between the bordering regions of Russia and Ukraine, where the main production potential is concentrated. This conclusion is made in the report presented by Eurasian Development Bank’s (EDB) Centre for Integration Studies and titled Cross-Border Cooperation between Russia, Belarus and Ukraine. The report has been prepared by experts from these three countries led by the Russian Academy of Sciences’ Institute of Economics (IERAS).

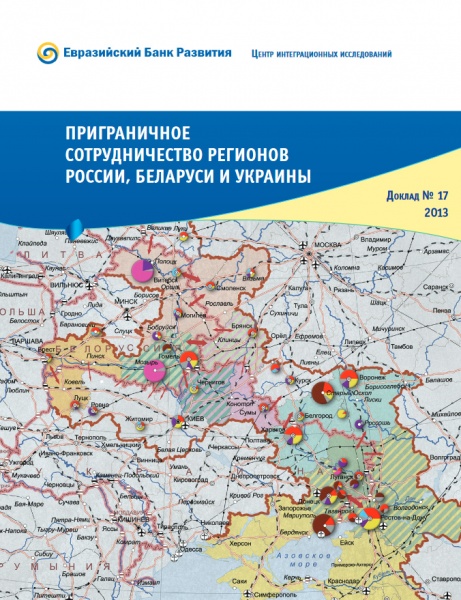

The Belarus-Russia-Ukraine cross-border micro-region (BRU-27), having a total area of 900,000 sq m and 4,460 km of borders, have significant human and industrial potential. Its population totals 50 million people and the aggregate gross regional product at purchasing power parity (GRP PPP) exceeds US $460 billion. Ukrainian and Russian regions make the largest contribution to the aggregate industrial (48.3%) and agricultural (48.2%) production respectively. At the same time, Russian cross-border regions concentrate 80% of all investment in BRU-27, while Ukrainian and Belarusian regions lag behind in these terms. The BRU cross-border regions vary significantly in terms of the scale of their economies and their importance to their respective national economies. For Belarusian cross-border regions, GRP PPP accounts for 36% of the country’s GDP (PPP), for Russian 8%, and for Ukrainian 61%. Over 50% of the economic potential of the three countries’ cross-border regions is concentrated in the southern part of the Russian-Ukrainian section of BRU-27.

International functional regions are being formed on the Belarus-Russia and Russia-Ukraine sections of the border, based on economic and investment ties inherited from the Soviet times and arising in new economic conditions. Out of all mutual foreign direct investment accumulated by Russia, Belarus and Ukraine in the CIS countries, 30% (US $14 billion) are concentrated in their respective cross-border regions. Two functional types of regions exist: transport and logistical regions (Polessye and Desna) and complex regions (Upper Dnieper, Bryansk-Gomel, Slobozhansky and Donetsk regions).

The history of cross-border cooperation between Belarus, Russia and Ukraine suggests that the most effective tool to develop production, investment and sales between cross-border regions is companies that have assets in neighbouring countries and cooperate with each other.

After a drastic recession caused by the global financial and economic crisis, in 2011 the aggregate exports from BRU-27 to Belarus, Russia and Ukraine significantly exceeded the pre-crisis figures, approximating US $21 billion. In 2012, however, this figure went down by 7.3% because of a reduction in exports from Ukrainian border regions to Russia.

The data and conclusions presented in the report provide detailed information about the dynamics of cross-border ties between the three countries over the past twenty years. The authors of the report expect to help businesses to better navigate in the region’s economic space and the countries to take into account the opportunities associated with the development of mutually beneficial relationships between them.