Advanced Manufacturing Potential in Eurasia: Sectoral Niches for Growth

-

Report

PDF, 3.97 Mb -

Key findings

PDF, 402.82 Kb -

Summary

PDF, 927.07 Kb

The economies of the Eurasian region – Armenia, Belarus, Kazakhstan, Kyrgyzstan, Russia, Tajikistan and Uzbekistan – have historically developed within the framework of an export-oriented raw materials model, focusing on the extraction and primary processing of natural resources for supply abroad. Consequently, the region imports high-value products, creating a sustainable dependence on external markets. Industry is characterised by low and non-homogenous technological complexity, a predominance of minimally processed products, and limited cooperation between countries in more complex industrial segments.

International experience shows that the limitations of the export-raw materials model can be overcome by diversifying industry and exports. At a higher stage of economic development, knowledge-intensive and high-tech goods become increasingly important. Developing high-value-added industries becomes an engine of economic growth, helps form new industries, reduces environmental impact and contributes to a technologically sustainable economy. In the context of global transformations, it is high-tech industry that determines countries' sustainability and innovative competitiveness.

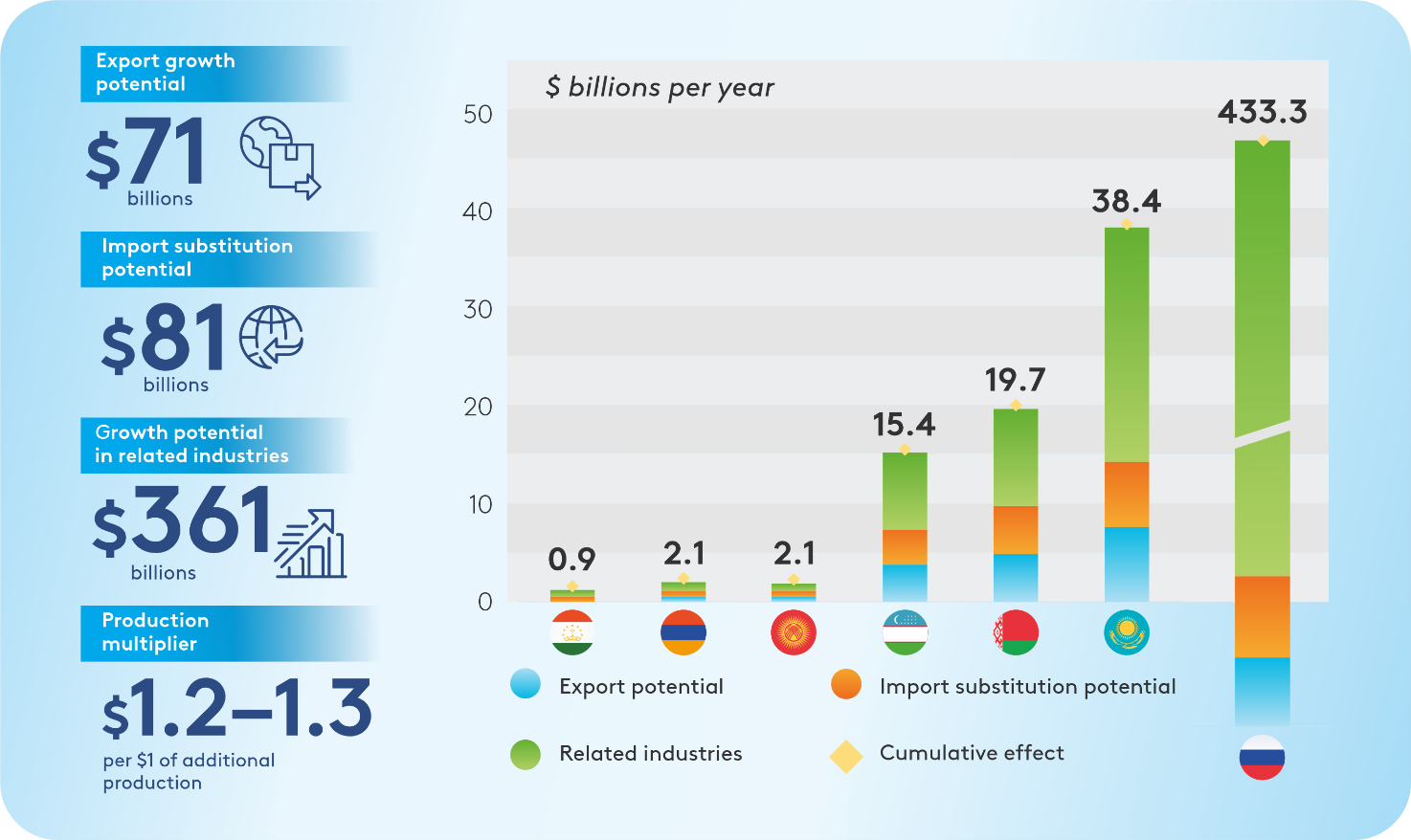

The industrial potential of the Eurasian region today allows us to anticipate a significant increase in exports. Its annual growth could exceed $70 billion. The most significant growth is forecast in Kyrgyzstan, Uzbekistan and Armenia, at between 25% and 28%. Moderate growth of 12-17% is expected in Russia, Belarus, Kazakhstan and Tajikistan. This growth will be driven by products from the second stage of processing. Promoting these products abroad will not only increase exports, but also diversify the economic structure, revitalise the machine building industry and create new industry clusters.

A summary assessment of the implementation of the industrial potential of the Eurasian region is provided.

Source: EDB calculations.

Import substitution could have a similar impact, generating more than $80 billion per year. Russia has the greatest potential, with the possibility of localising up to 23% of imports. In the other regional economies, the potential ranges from 11% to 16%. This mainly concerns second-stage processing products, including equipment and components. Import substitution is regarded as a means of reducing vulnerability, strengthening the industrial base, and adapting to global challenges. It also provides an impetus for technological modernisation.

The cumulative effect of export growth, import substitution and increased output in related industries could exceed $510 billion annually. Additional growth will primarily affect the electric power industry, wholesale and retail trade, transport services, agriculture, chemical production and metallurgy. This reflects an increase in production for both foreign markets and domestic consumption.

The key task for the Eurasian region is to develop an active industrial policy that focuses on economic diversification and the development of high-value manufacturing. At the same time, efforts should be combined to replace imports with the expansion of export potential, in order to reduce vulnerability to external shocks while occupying high-income market segments.

Focusing on the chemical industry (including pharmaceuticals), mechanical engineering, metallurgy, and the food industry is recommended, as these sectors have the greatest growth potential and can provide a significant multiplier effect. Additionally, developing niche industries in the second stage of processing in each country is advisable in order to establish national growth points and leverage local strengths. A key task is to localise the production of essential components and reduce critical import dependence. This will bolster economic security and lay the groundwork for further expansion into foreign markets.

The ultimate goal is to establish a modern industrial system that can process resources within the region, generate employment and develop technologically complex products. The Eurasian region's natural and resource advantages provide a unique opportunity to transition to a new type of industrialisation focused on added value, sustainability, and technological leadership.