China and the Eurasian Region: Analysis of Investment Flows based on EDB Monitoring of Mutual Investments

-

Report

PDF, 2.98 Mb -

Summary

PDF, 1.26 Mb -

Key Findings

PDF, 718.99 Kb -

Presentation

PDF, 6.64 Mb

The Eurasian Development Bank (EDB) is continuing its series of publications as part of its flagship analytical project, the Monitoring of Mutual Investments (EDB MMI). The second report focuses on China, a key investment partner for the Eurasian region in 2025.

The EDB MMI is based on a bottom-up database of investment projects compiled from open sources and containing detailed information on projects implemented in the Eurasian region.

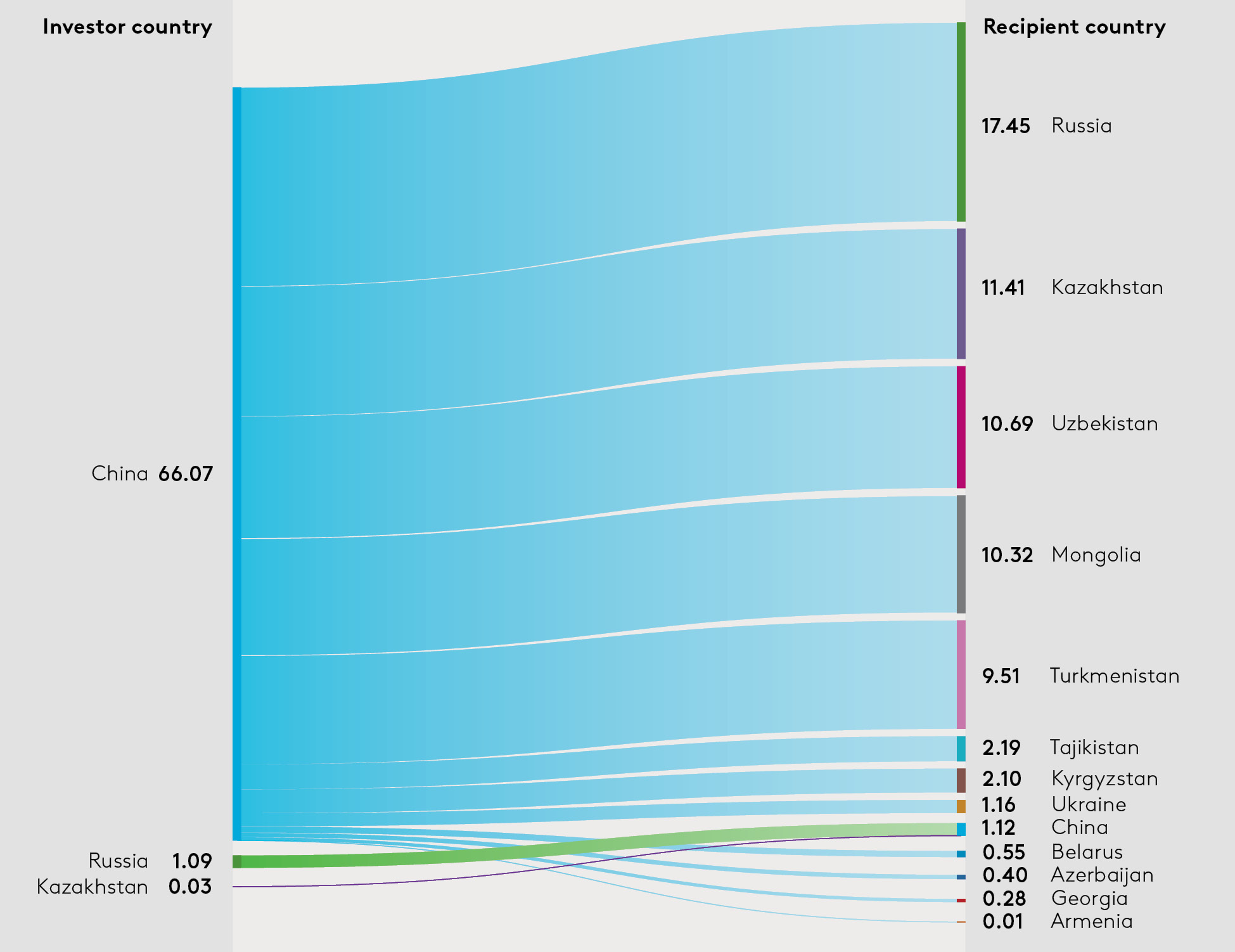

China’s investment in Eurasia is growing amid a global downturn. Over the past ten years, this investment has increased by 80% to a record $66 billion by the end of the first six months of 2025.

Cooperation has been confirmed at the high level. The priority of investment cooperation is enshrined in the Tianjin Declaration of the SCO and the Astana Declaration of the Second Central Asia–China Summit and is aligned with the objectives of the Belt and Road Initiative (BRI).

Russia is the largest recipient of Chinese FDI. As of the first half of 2025, the investment stock there reached $17.5 billion.

China’s FDI stock in Central Asia has increased over ten years to $35.9 billion. Kazakhstan remains the largest recipient of Chinese FDI at $11.4 billion, while Uzbekistan is showing rapid growth and has increased attracted FDI to $10.7 billion by mid-2025.

Mutual investment flows between China and Eurasian countries, $ billions

Source: EDB MMI database.

Greenfield projects dominate. The share of greenfield investment rose from 43% to 60%, reflecting the technological maturity of Chinese companies.

A structural shift from extractive industries to manufacturing and energy. The share of manufacturing increased from 13% to 22% and that of the energy sector from 4% to 12%, while the share of extractive industries fell from 68% to 54%.

Manufacturing, energy including renewables, transport and logistics and agriculture remain the most attractive sectors for Chinese investors in the Eurasian region. This reflects a combination of structural shifts within Eurasian economies and China’s strategic priorities to secure leadership in high-tech industries, diversify value chains, develop green energy and low-carbon transport and ensure food security.