Cooperation of Multilateral Development Banks in Emerging Markets and Developing Countries: Untapped Opportunities

-

Report

PDF, 3.52 Mb -

Key findings

PDF, 304.77 Kb -

Presentation

PDF, 4.00 Mb -

Summary

PDF, 1.15 Mb

Today, emerging markets and developing countries (EMDCs) face widening financing gaps and escalating infrastructure needs. To reach the Sustainable Development Goals (SDGs) by 2030, developing countries require an estimated $4 trillion annually, nearly double the financing gap assessed in 2015.

EMDCs are entering a new phase of economic collaboration. While traditionally reliant on linkages with advanced economies in trade, investment, and finance, EMDCs are increasingly recognizing the need to cultivate strong ‘horizontal linkages’ among themselves. This shift marks an important milestone for global development, enabling countries to better pool financial resources, knowledge, and expertise to address shared challenges and accelerate sustainable growth.

Multilateral Development Banks (MDBs) play a central role in enabling this coordination. Notably, MDBs established by EMDCs – often-referred to as borrower-led MDBs – have expanded significantly over the past decade. Between 2012 and 2024, their balance-sheet lending volumes tripled, reaching approximately $150 billion. These institutions bring a unique value proposition: deep regional knowledge, close ties with member governments, operational flexibility, and the ability to respond quickly to local challenges.

However, despite their strengths, borrower-led MDBs typically possess smaller capital base and lower credit ratings, which limit their capacity to raise affordable long-term financing. Strengthening cooperation – both horizontally among borrower-led MDBs and vertically between smaller and larger global MDBs – can unlock substantial development benefits.

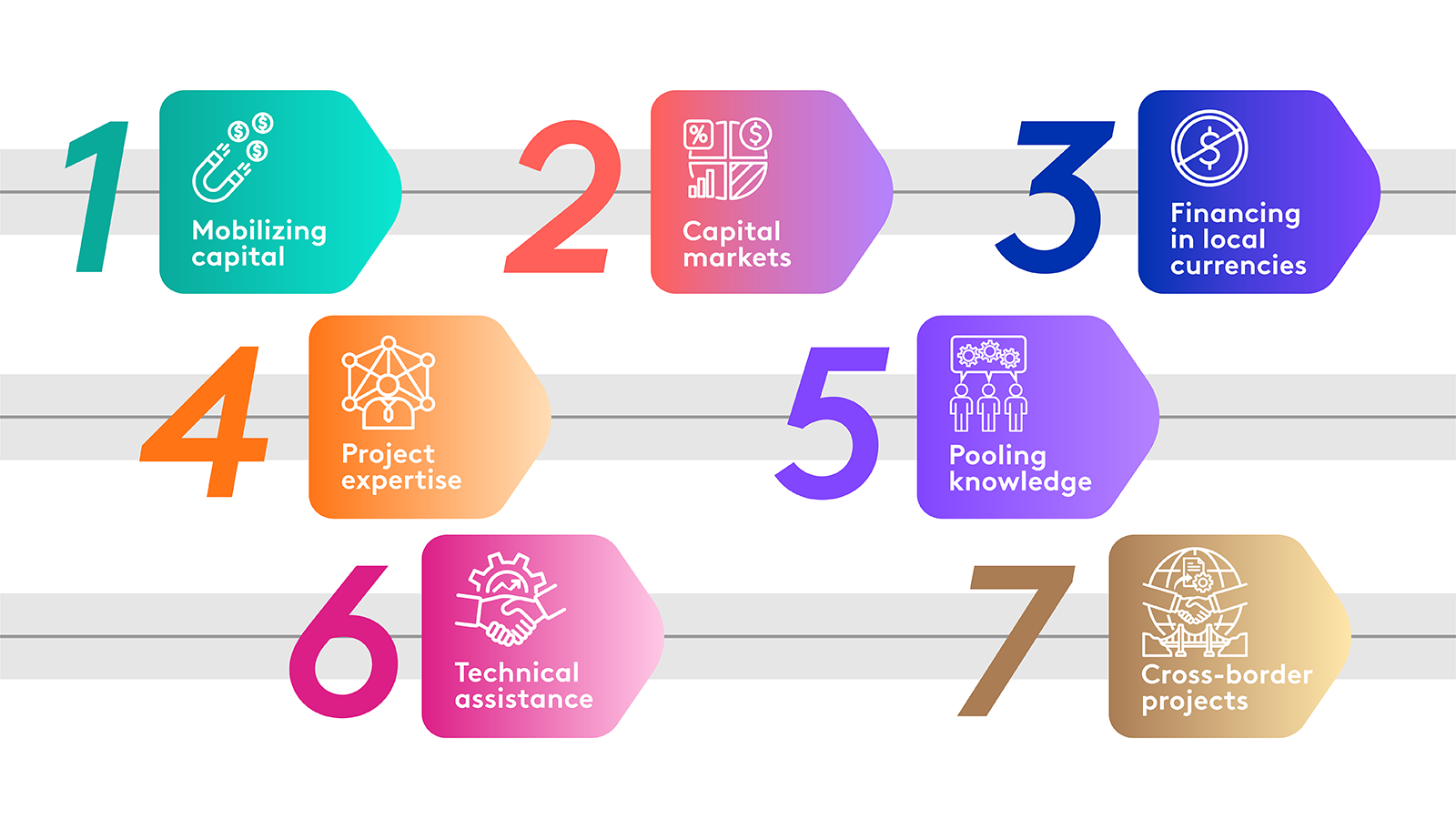

The report identifies seven areas in which MDB collaboration can significantly reduce costs, improve project effectiveness, and accelerate development outcomes in EMDCs.

Seven Areas of Enhanced MDB Cooperation

Source: EDB.

1. Mobilizing Capital. Joint participation enables MDBs to launch large-scale infrastructure projects that are otherwise unattainable due to capital and risk constraints. Instruments such as Exposure Exchange Agreements help distribute risk across institutions—an innovation first implemented in 2015, covering $6.5 billion across AfDB, IDB, and IBRD.

2. Capital Markets. Through equity participation, investments in each other’s bonds, and collaboration on climate-related and sustainability-linked instruments, stronger MDB partnerships can expand regional capital markets and improve borrowing terms for lower-rated institutions.

3. Local-Currency financing. Lending in local currencies mitigates exchange-rate risks that can threaten borrower stability. Larger MDBs can provide hard-currency financing to smaller MDBs, which then on-lend in local currency while hedging exposure.

4. Project Expertise. Cooperation improves project preparation, long-term structuring, risk management, and the implementation of public-private partnerships (PPPs). Cross-regional collaboration also facilitates knowledge transfer and the adoption of best practices.

5. Pooling Knowledge. MDBs possess extensive analytical capacity across regional and thematic areas. Joint research programs, shared data platforms, and training centers enhance decision-making and support more effective development strategies.

6. Technical Assistance. Pooling resources by MDBs for technical assistance strengthens project design quality and supports early-stage development, paving the way for pipeline expansion and future joint investments.

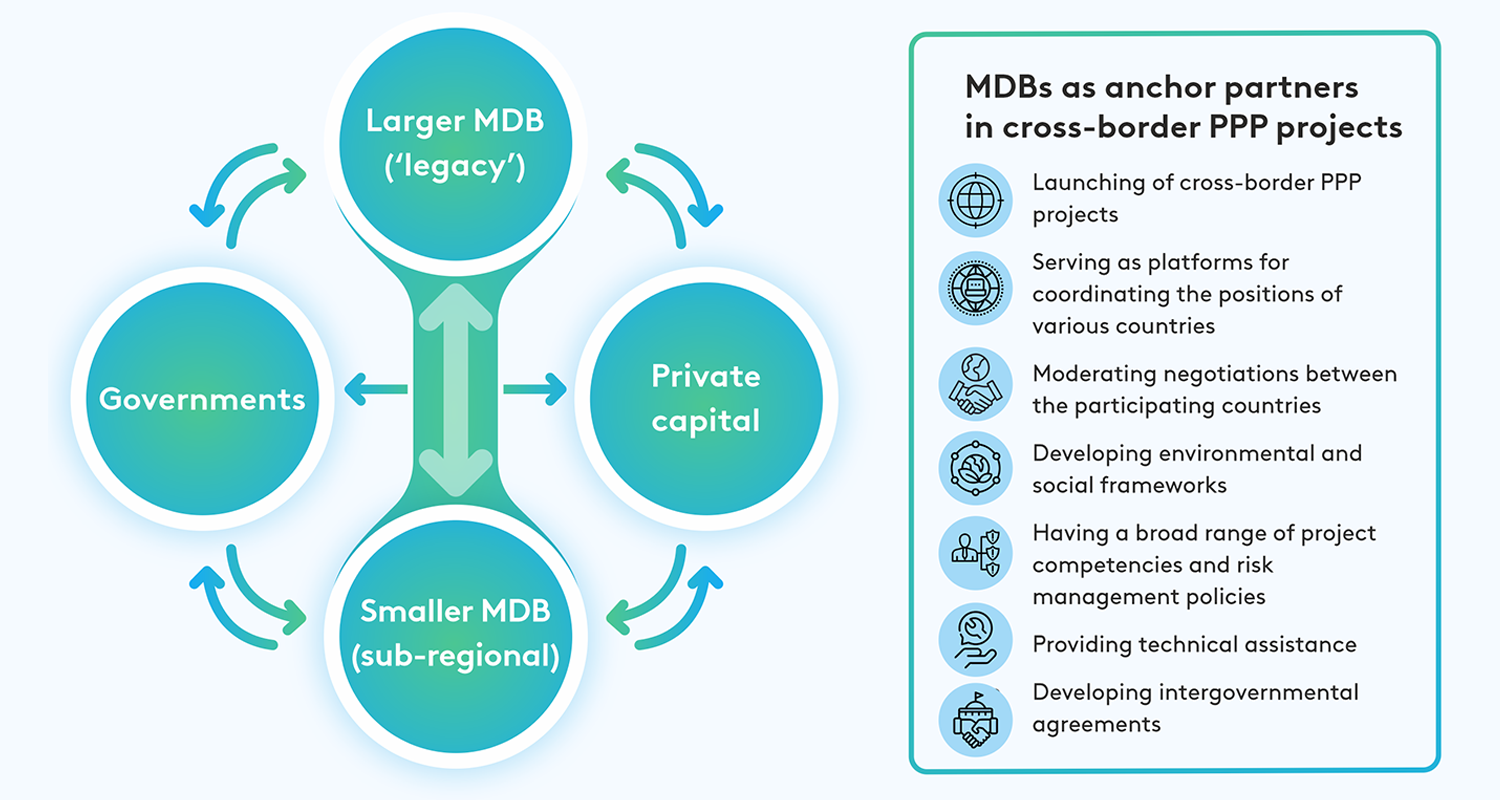

7. Cross-Border development Projects. MDBs can act as catalysts for regional integration by coordinating cross-border investments, facilitating feasibility studies, mitigating political risks, and anchoring private-sector participation.

Key Sectors for Deepened MDB Collaboration

The report illustrates possible areas for MDB cooperation and its potential economic impact for developing countries.

- Water–Energy–Food Nexus. MDBs can support the formation of regional consortia or dedicated project development centers to coordinate large-scale initiatives. By providing long-term syndicated lending, advisory services, and financial operations, MDBs can enhance sustainability and resource efficiency. Proposed structures include BOT/BOOT project consortia and dedicated nexus development centers.

- Sustainable Transport Connectivity. Joint MDB action can drive the creation of economically viable transport corridors, develop resilient and low-carbon mobility systems, and support digital infrastructure solutions. Mechanisms include co-financing, integrated planning, and facilitation of cross-border procedures such as border management, insurance systems, and logistics digitalization.

- Sustainable and Climate Finance. By co-arranging green syndicated loans, issuing GSS+ bonds, and supporting national and regional climate initiatives, MDBs can mobilize large-scale financing while harmonizing sustainability and ESG standards. The EBRD’s Green Economy Financing Facility (GEFF) provides a strong example of multilateral collaboration in this sphere.

- Cross-Border Infrastructure. Coordinated MDB involvement is essential for planning, financing, and executing large projects that span multiple jurisdictions. MDBs are uniquely positioned to mitigate political risks, align national strategies, and ensure financial sustainability, especially in PPP-driven projects.

Cross-border PPP projects are an example of the importance of MDBs' cooperation