Investing in the future: projects of international financial organizations in Eurasia

-

Report

PDF, 4.00 Mb -

Summary

PDF, 1.68 Mb -

Presentation

PDF, 2.17 Mb

This report is based on the EDB's extensive and systematic database on non-sovereign financing, which includes more than 2,000 approved non-sovereign projects of 16 IFIs in 11 countries of the region for 2008-2024. Analysis of the accumulated data on approved operations reveals key trends and dynamics in the development of IFI non-sovereign financing in the countries of the Eurasian region.

Ten key trends reflecting the dynamics and structural shifts in this area have been analyzed and identified.

Trend 1. Decrease in real volumes of non-sovereign financing by IFIs over a 17-year period. The 17.4% decline is explained by high dollar inflation, weak nominal growth rates, and the peculiarities of financing in certain countries in the region (hereinafter, the average annual financing volumes for 2008-2010 and 2022-2024 were compared).

Trend 2. Changing structure of leaders among IFIs. The EDB ranks first in terms of non-sovereign financing volumes for 2022-2024, followed by the EBRD in second place and the IFC in third. The EDB ranked third (after the World Bank and the ADB) in terms of all operations based on the consolidation with the EFSD database.

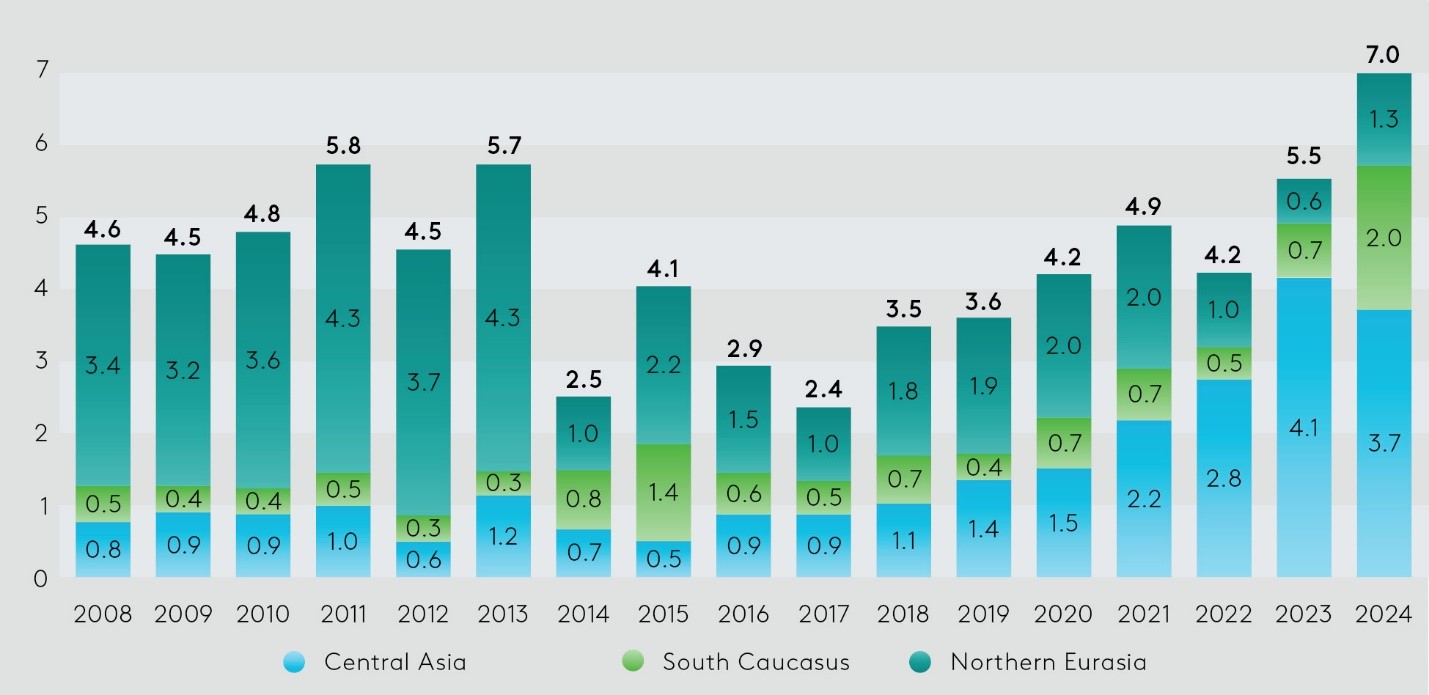

Trend 3. Concentration of new projects in Central Asia. The share of financing for Central Asia in the Eurasian region grew from 18% to 63%. The average annual volume of financing increased by more than four times to $3.4 billion.

Trend 4. Dynamic growth of non-sovereign investments in the South Caucasus. The share of the South Caucasus in the region increased from 9% to 20%, and the average annual volume of financing increased from $0.4 billion to $1.1 billion.

Trend 5. Renewable energy – new sectoral priority for IFIs. The share of renewable energy grew from zero to 18%. The shift towards renewable energy has led to a reduction in IFI financing in other important sectors of the economy: the financial sector (share decreased from 38.2% to 32.9%), mechanical engineering (from 5.5% to 0.6%), and agribusiness (from 7.7% to 3.5%).

Trend 6. Boom in green projects in the energy and financial sectors. The share of green projects (in the energy and financial sectors) in the structure of non-sovereign financing by IFIs increased from 8% to 32%.

Trend 7. Onlending – a mechanism for financing small and medium-sized enterprises. The volume of such financing increased by 31%, which is higher than the average growth of non-sovereign investments. The interest of IFIs in onlending is linked to the growing challenges of increasing investment in SMEs.

Trend 8. Reduction in co-financing (a decline of 33%). The decline is mainly due to the EBRD's reorientation of its activities from Russia to other countries in the region. In Central Asia, co-financing volumes are gradually growing.

Trend 9. Strengthening the role of bonds in the financing system. Their share in the structure of all instruments has grown from 0.5% to 7%. Investment loans account for the majority of non-sovereign projects – more than 80%.

Trend 10. Increasing importance of financing in national currencies. The average annual volume of such operations increased by 50% – from $0.8 billion to $1.2 billion.

Non-sovereign financing of IFIs in the Eurasian region in 2008-2024 by subregion, $ billions

Source: NSF database.

Source: NSF database.

Looking ahead: priorities and projects in Eurasia

The activities of international financial organizations, particularly multilateral development banks, have been actively discussed in recent years and are the focus of attention of the international community.

In the context of global challenges, it is extremely important to take into account the specific characteristics of individual regions. Doing so is key to effective economic strategies. The Eurasian region has its own distinguishing characteristics. The region faces three key challenges that are important for IFIs to consider: (1) achieving not only sustainable but also rapid economic growth; (2) transport accessibility; (3) access to water.

The following actions could significantly increase the positive impact of non-sovereign IFI investments on the future of the Eurasian region.