Investment Cooperation in the Eurasian Region based on EDB Monitoring of Mutual Investments

-

Report

PDF, 2.72 Mb -

Key Findings

PDF, 423.98 Kb -

Summary

PDF, 878.76 Kb -

Presentation

PDF, 6.64 Mb

The Eurasian Development Bank (EDB) is continuing its series of publications as part of its flagship analytical project, the Monitoring of Mutual Investments (MMI EDB).

The EDB MMI is based on a bottom-up database of investment projects compiled from open sources and containing detailed information on projects implemented in the Eurasian region.

The foreign direct investment (FDI) stock between countries in the region reached a record $48.4 billion at the end of the first half of 2025. New data shows that investment activity in the Eurasian region is growing despite the global decline in foreign direct investment (minus 11% in 2024).

Private business has been the main driver of investment growth. The share of private companies in investments has grown to 72%, with their FDI stock amounting to $34.7 billion.

By mid-2025, greenfield projects became the dominant type of investment in the region for the first time, with their share rising to 40%, while the share of brownfield projects fell to 39%.

There is a gradual structural shift from investment in the extractive sector to the development of the manufacturing sector. The share of the extractive sector has declined, while investment in the Eurasian region's manufacturing sector has grown by a record $1.5 billion over the past year and a half.

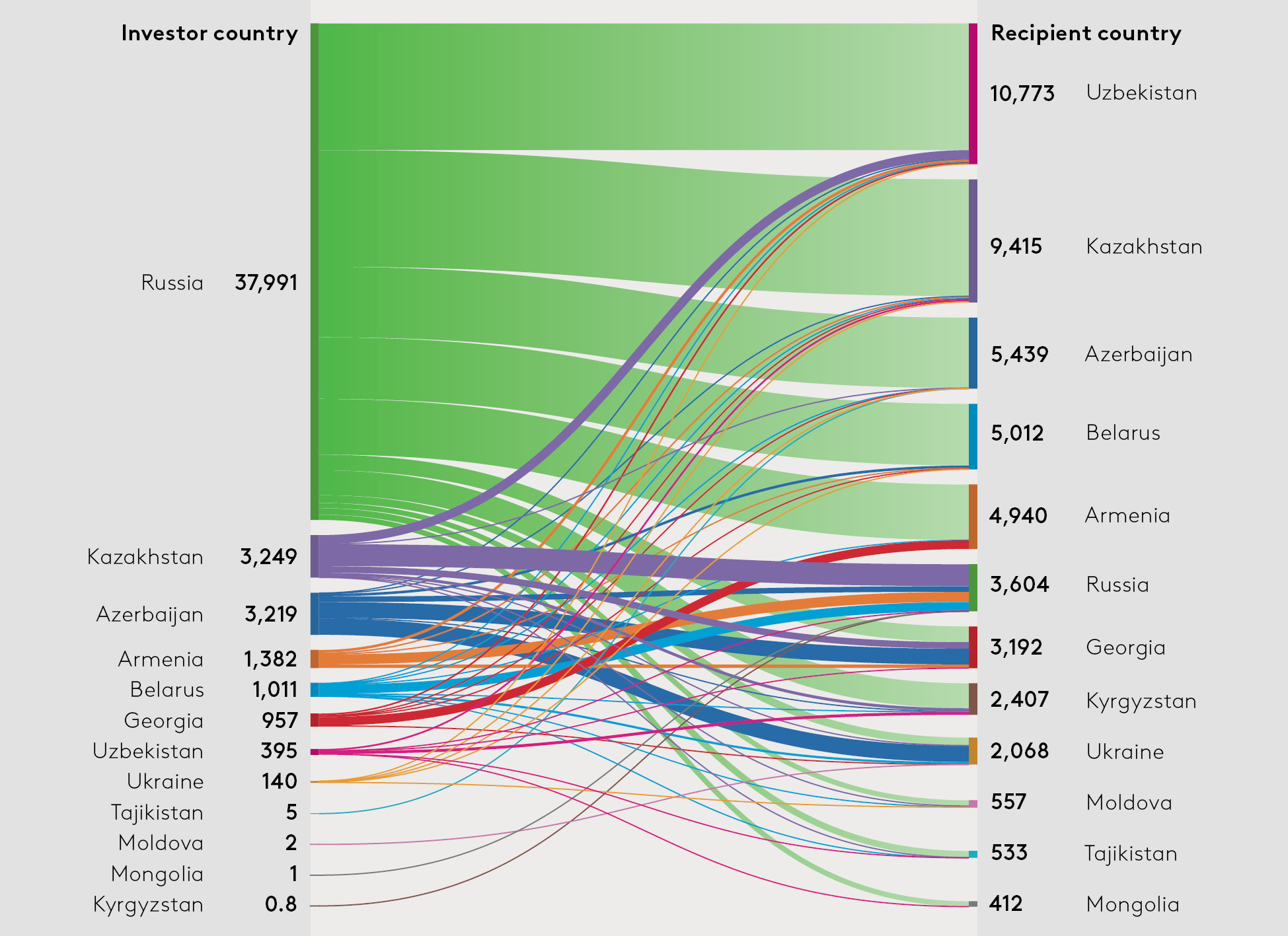

Russia is the largest investor in the Eurasian region with a share of 78.6%. At the same time, the role of other countries is growing. Kazakhstan and Uzbekistan are becoming key players: Kazakhstan is one of the largest investors and recipients (outward investment stock − $3.25 billion, inward investment stock − $9.4 billion), while Uzbekistan is the largest recipient of FDI from the Eurasian region ($10.7 billion, or 22.3% of the regional volume).

Directions of mutual FDI stock by country, $ millions

Source: EDB MMI database

Within the EAEU, the volume of mutual investments reached a historic high of $23.4 billion (+42% compared to 2016). The share of the Union countries in the total volume of mutual FDI in the Eurasian region grew to 48.4%.

In the CIS, mutual FDI stock increased to $41.6 billion (+56% compared to 2016). At the same time, investment flows are increasingly shifting towards Central Asian countries, primarily Uzbekistan and Kazakhstan.

Intraregional investment in Central Asia reached $1.3 billion in the first half of 2025, an increase of 42% compared to 2023 and almost three times the 2016 level. Approx. 80% of all FDI is concentrated in construction, manufacturing, and the financial sectors. This reflects the region's gradual transition from an extractive model towards a more diversified investment structure.

Four sectors demonstrate increased attractiveness to foreign investors in the Eurasian region: manufacturing, energy (including renewable energy sources), transport and logistics, and agro-industrial complex.