Macroeconomic Outlook 2026-2028

-

Report

PDF, 4.35 Mb -

Presentation

PDF, 18.60 Mb -

Key Findings

PDF, 235.77 Kb -

Summary

PDF, 1,010.11 Kb

The EDB has published a report assessing developments in the global economy and the Eurasian region. According to EDB analysts' forecasts, the global economy will maintain moderate growth rates and gradually adapt to new trade barriers. Growth in developed economies remains weak, while emerging economies with large markets continue to enjoy heightened economic activity. The US is expected to grow by around 1.6% in 2026. High debt levels will hold back investment, but IT infrastructure construction will support economic activity. Growth in the eurozone will remain weak, at around 1.1%, mainly supported by increased government investment in defence and infrastructure. The Chinese economy will continue to grow at a rapid pace, with a forecast of 4.6% in 2026, helped by the authorities' efforts to stimulate domestic demand.

Inflation in the US and the eurozone will remain above target levels in 2026–2028. Rising costs amid tariff conflicts are limiting the pace of rate cuts in the US and may trigger an increase in ECB rates in 2026.

The economy of the EDB’s region of operations will continue to expand steadily, reaching a growth rate of 2.3% by the end of 2026. The projected dynamics of the global economy and commodity markets will not create serious obstacles to economic growth in the Eurasian region, although they are unlikely to act as a driver of growth. Growth rates in most countries of the region will remain high, supported by strong investment activity. Inflation is expected to gradually decline toward target levels. Price growth in the region is forecast to slow to 6.3% in 2026 from 6.9% in 2025, in the absence of additional shocks, due to the balanced monetary policies pursued by regulators in the EDB member countries.

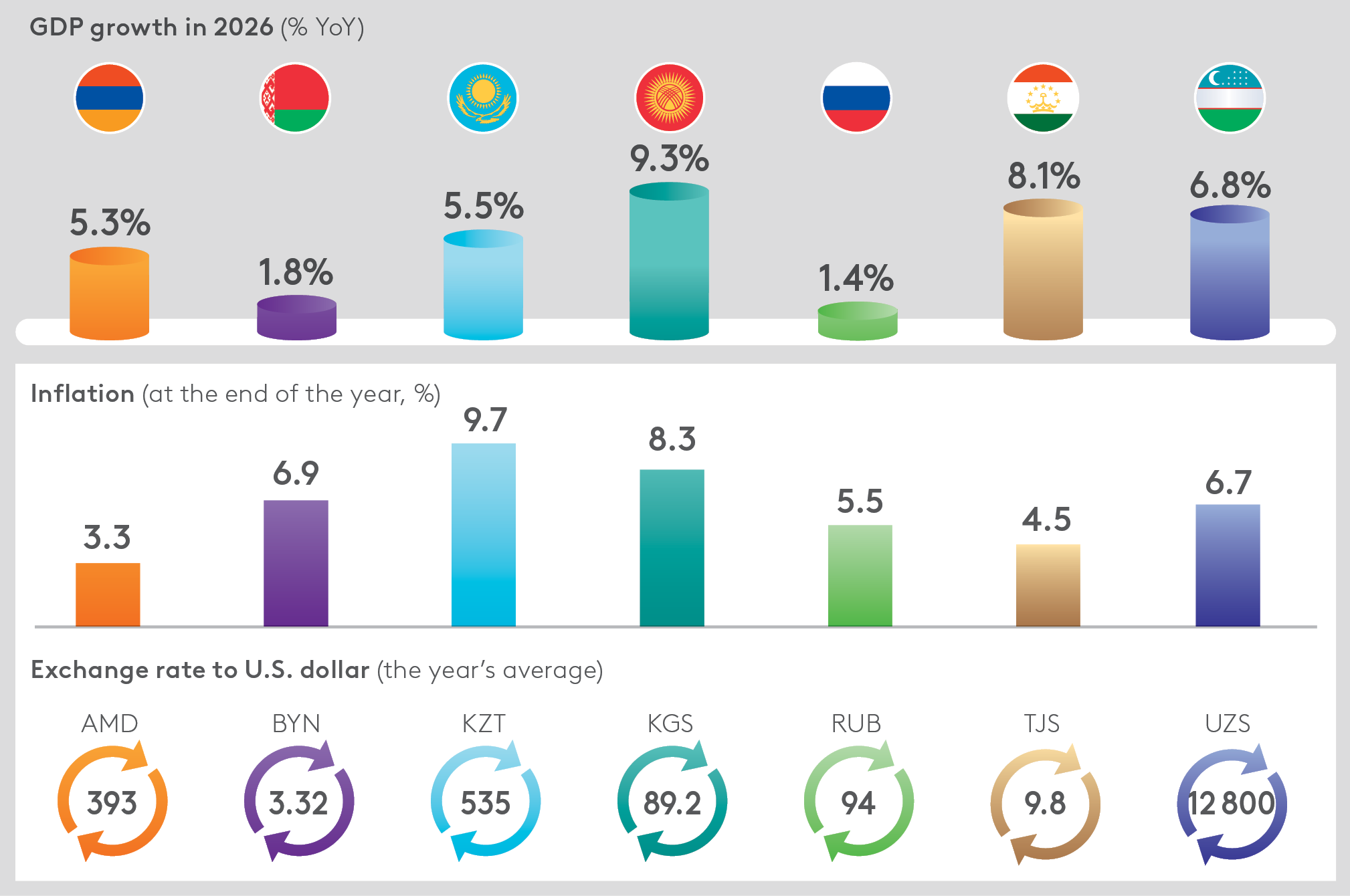

Key macroeconomic forecasts for the EDB member states in 2026

Source: EDB analysts’ calculations

According to EDB forecasts, Armenia's GDP will grow by 5.3% in 2026. The main factor behind the sustained high economic growth rates is domestic consumer and investment demand, supported by increased savings and lending activity. Inflation will stabilise around the target level of 3±1% and will be 3.3% at the end of 2026. The dram exchange rate is expected to average AMD 393 per US dollar for the year due to growth in imports driven by strong domestic demand.

In Belarus, GDP will grow by 1.8% in 2026, as in the current year, and economic development will accelerate in the future. Growth continues to be held back by declining demand for Belarusian products due to the economic slowdown in Russia, a key trading partner. At the same time, high investment and consumer activity are supporting economic growth. Inflation in Belarus will remain close to the updated target of 7%. Its faster slowdown constrained by import price pressure from Russia and a labour shortage. The average exchange rate of the Belarusian ruble in 2026 is expected to be BYN 3.32 per US dollar. The moderate weakening of the exchange rate is due to an increase in imports and a decrease in exports of goods. The exchange rate will be supported by the continued net sale of foreign currency by households.

EDB analysts expect Kazakhstan's economy to maintain steady growth of 5.5% in 2026. The implementation of the National Infrastructure Plan and the launch of the state programme ‘Order for Investment’ will mitigate the negative impact of lower oil prices. The economy will also be supported by an increase in non-commodity exports. Moderately tight monetary conditions will ensure a decline in inflation to 9.7% by the end of 2026, after peaking in early 2026 amid an increase in VAT. The average tenge exchange rate in 2026 will be KZT 535 per US dollar. The exchange rate will be supported by a high base rate and growth in non-commodity exports.

In 2026, the economy of the Kyrgyz Republic will maintain its leadership in the region in terms of GDP growth, which will amount to about 9.3%. This dynamic will be shaped by increased investment in transport, energy, water supply and housing construction. EDB analysts expect inflation to slow to 8.3% by the end of 2026. A faster decline in inflation will be limited by increases in tariffs and excise duties. The average som exchange rate in 2026 is expected to be KGS 89.2 per US dollar, supported by growth in remittances and the high cost of gold, the republic's key export commodity.

In Russia, EDB analysts forecast economic growth of 1.4% in 2026. A return to sustainable GDP growth rates is expected in the future thanks to continued fiscal stimulus and the resumption of lending. Inflation will continue to decline towards the target level and will be 5.5% at the end of 2026. The VAT increase and labour shortage will keep inflation above target. According to EDB analysts' forecast, the Russian rouble exchange rate will weaken to RUB 97 per dollar by the end of 2026 amid lower oil prices, gradual rate cuts and a reduction in currency sales by the Bank of Russia.

Tajikistan's economy will maintain high GDP growth rates in 2026 – around 8.1% according to EDB analysts' forecast. The main drivers are capacity expansion in the energy and manufacturing industries, and higher prices for gold and non-ferrous metals. Inflation will rise to 4.5% by the end of 2026 and remain within the target range of 5±2%. The somoni exchange rate will remain stable thanks to increased exports and remittances. The average somoni exchange rate in 2026 is expected to be approximately TJS 9.8 per US dollar.

EDB analysts expect Uzbekistan's economy to continue growing at a steady high rate of around 6.8% in 2026. Growth will be driven by high investment and favourable gold prices. Inflation will continue to decline towards the Central Bank of Uzbekistan's target and may slow to 6.7% by the end of 2026. This will be facilitated by relatively tight monetary conditions and the stability of the soum exchange rate — approximately UZS 12,800 per US dollar on average for the year. The national currency will be supported by continued high levels of remittances and growth in metal exports amid favourable price conditions.